Bitcoin works by utilizing blockchain technology to facilitate peer-to-peer transactions, with miners verifying and adding transactions to the decentralized ledger, earning rewards in the form of new bitcoins. Utilizing complex algorithms, Bitcoin transactions are secure, transparent, and tamper-proof, making it a popular digital currency for investment and online transactions.

Bitcoin, a decentralized digital currency, has gained popularity as a lucrative investment option and a mode of online payment. With its innovative blockchain technology, Bitcoin operates independently of any central authority, offering transparency and security to users. We will delve deeper into how Bitcoin works to generate wealth, explore its potential benefits and risks, and provide insights for individuals looking to delve into the world of cryptocurrency investing.

Bitcoin Mining

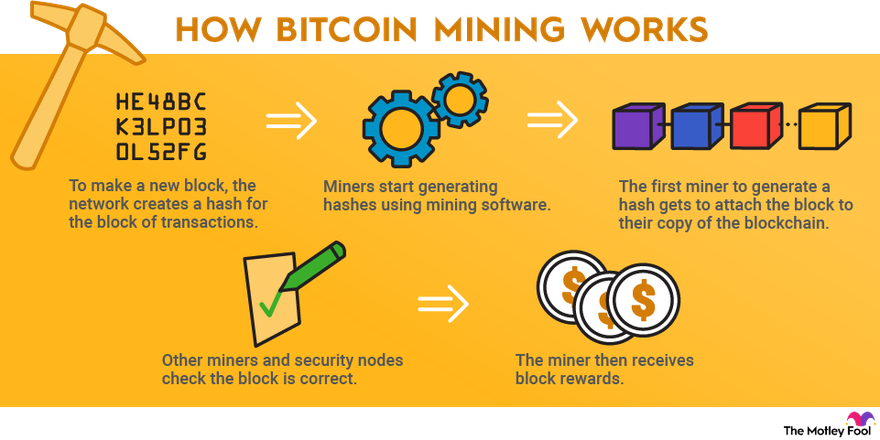

Bitcoin mining is the process by which new bitcoins are created and transactions are recorded and verified on the blockchain. The process of mining Bitcoin involves powerful computers solving complex mathematical problems in order to add new blocks to the blockchain. Miners are rewarded with newly created bitcoins and transaction fees for their efforts. This process is essential to the functioning of the Bitcoin network and is what allows new bitcoins to be introduced into circulation. The mining rewards serve as an incentive for miners to contribute their computing power to secure the network and process transactions.

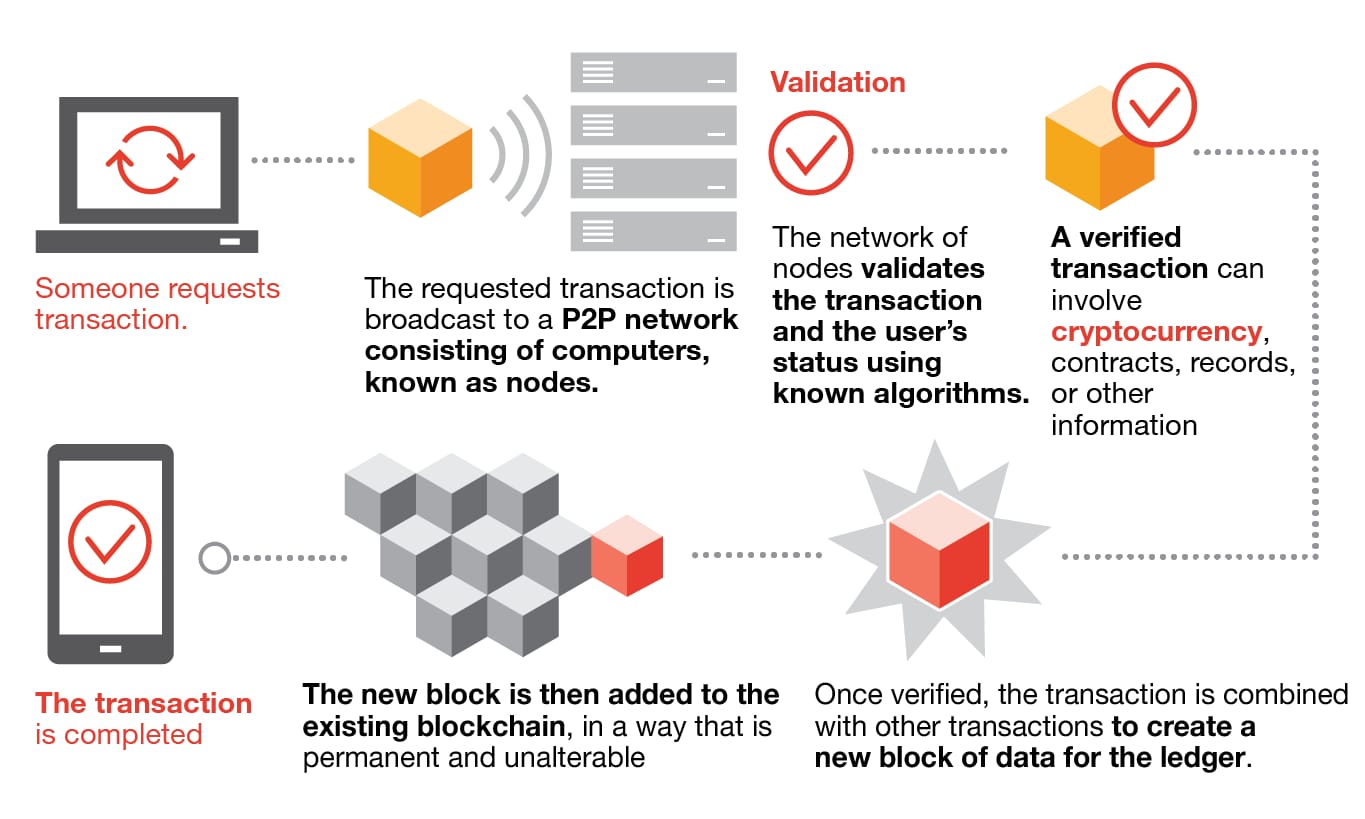

Bitcoin Transactions

Bitcoin transactions involve transferring digital currency between users via the blockchain network. Each transaction is verified by miners to earn Bitcoin rewards. This decentralized system ensures secure peer-to-peer money exchanges, allowing individuals to make financial transactions without the need for intermediaries.

| Bitcoin Transactions |

| Bitcoin transactions involve digital currency exchanges through a decentralized network. |

| Blockchain technology secures transaction data with cryptographic techniques. |

| The verification process is done by miners to ensure transaction validity. |

Bitcoin Wallets

There are two main types of Bitcoin wallets: hardware wallets and software wallets. Hardware wallets are physical devices that securely store your Bitcoin offline. Software wallets, on the other hand, are applications or online services that help you manage your Bitcoin online.

Securing your Bitcoin wallet is crucial to protect your cryptocurrency from theft. Make sure to use a strong password and enable two-factor authentication. It’s also recommended to keep your private keys offline and use reputable wallet providers.

Bitcoin Exchanges

Bitcoin exchanges are platforms where users can buy, sell, and trade bitcoins. This digital currency operates on a decentralized network, allowing individuals to make money through trading and investing in Bitcoin. The process involves buying Bitcoin at a lower price and selling it at a higher value, capitalizing on market fluctuations to generate profits.

| Popular Bitcoin exchanges | Features |

|---|---|

| Coinbase | Easy to use platform |

| Bitstamp | High liquidity |

| Kraken | Advanced trading options |

Bitcoin Exchanges: When it comes to buying and selling Bitcoin, there are several popular exchanges to consider. Some of the noteworthy ones include Coinbase, known for its easy-to-use platform, Bitstamp, offering high liquidity, and Kraken, providing advanced trading options.

By utilizing these exchanges, individuals can easily engage in the buying and selling of Bitcoin without any hassle. Each platform comes with its own unique set of features catering to the varying needs of users interested in Bitcoin transactions.

Investing In Bitcoin

Investing in Bitcoin can be a lucrative opportunity to make money. Understanding Bitcoin as an investment is essential to mitigate risks and maximize benefits. Bitcoin is a decentralized digital currency that operates on a technology called blockchain. It allows individuals to send and receive funds securely and anonymously. One of the primary risks associated with investing in Bitcoin is its volatility.

The price can fluctuate significantly within a short period of time, making it a high-risk investment. However, this volatility also presents an opportunity for substantial profit. Additionally, investing in Bitcoin provides diversification in a portfolio, as it is not directly correlated with traditional assets such as stocks and bonds. However, it is essential to conduct thorough research and due diligence before investing in Bitcoin to understand the market trends and potential risks.

Bitcoin Trading

Bitcoin trading involves buying and selling bitcoins with the aim of making a profit. To start trading bitcoin, it is essential to understand its technical analysis. This analysis involves studying the historical price movements, patterns, and indicators to predict future price movements. By analyzing charts and indicators, traders can identify potential entry and exit points to maximize their profits.

When trading bitcoin, it is crucial to follow some tips for successful trading. Firstly, it is important to have a clear trading plan and stick to it. This plan should include setting specific goals, determining the risk tolerance, and setting stop-loss orders to protect against significant losses. Additionally, it is essential to stay updated with the latest news and developments in the cryptocurrency market as it can have a significant impact on bitcoin prices.

Bitcoin As A Digital Currency

Bitcoin is a decentralized digital currency that operates without a central authority. Users can send and receive coins on the peer-to-peer Bitcoin network. The blockchain technology ensures secure transactions and transparent record-keeping. One of the advantages of using Bitcoin is the low transaction fees compared to traditional banking systems. Additionally, Bitcoin provides a level of anonymity for users, as transactions are not tied to their real-world identities. However, there are challenges such as price volatility and security concerns. Despite these challenges, the future prospects of Bitcoin as a recognized and widely accepted form of currency are promising. The potential for innovation and widespread adoption continues to fuel the growth and development of Bitcoin and other cryptocurrencies.

Frequently Asked Questions Of How Bitcoin Works To Make Money

How Does Bitcoin Work To Make Money?

Bitcoin is a decentralized digital currency that relies on blockchain technology. It works by using complex algorithms to validate transactions and secure the network. Miners solve mathematical puzzles to add new blocks to the chain and are rewarded with newly created bitcoins.

Investors can also profit from Bitcoin by buying low and selling high on cryptocurrency exchanges.

Is Bitcoin A Good Investment For Making Money?

While Bitcoin can be a profitable investment, it is also highly volatile and carries risks. Its value can fluctuate dramatically, and it is subject to regulatory and security concerns. It is important to research and understand the market before investing in Bitcoin as a potential source of income.

Can Bitcoin Mining Be A Profitable Way To Make Money?

Bitcoin mining can be profitable, but it requires significant investment in hardware and electricity. The competition among miners is high, and the rewards decrease over time. To be profitable, miners must have access to low-cost electricity, efficient mining equipment, and stay up-to-date with the latest mining strategies.

Conclusion

As the digital currency market continues to expand, Bitcoin remains a viable option for making money online. Understanding the fundamentals of Bitcoin can provide insight into its potential for investors. By grasping how the blockchain technology works, individuals can develop strategies to capitalize on this evolving financial landscape.

Keep learning and stay updated to harness the power of this innovative currency.