Bitcoin works through a decentralized network of computers running the blockchain technology to verify and record transactions securely and transparently. This involves a process called mining, where miners compete to solve complex mathematical puzzles to add new blocks to the blockchain, earning rewards in the form of newly minted bitcoins and transaction fees.

Essentially, Bitcoin functions as a digital decentralized ledger, ensuring trust and security without the need for a central authority. It relies on cryptography to protect transactions and ensure the integrity of the network. The blockchain serves as a public record of all transactions, accessible to anyone, yet tamper-proof due to its distributed nature.

Bitcoin’s underlying technology has revolutionized the way we perceive and conduct financial transactions in the digital age.

What Is Bitcoin?

Bitcoin is a decentralized digital currency operating without a central authority. Its transactions are recorded on a public ledger called a blockchain. Created in 2009 by an anonymous person or group under the alias Satoshi Nakamoto, Bitcoin uses peer-to-peer technology to operate with no central authority or banks.

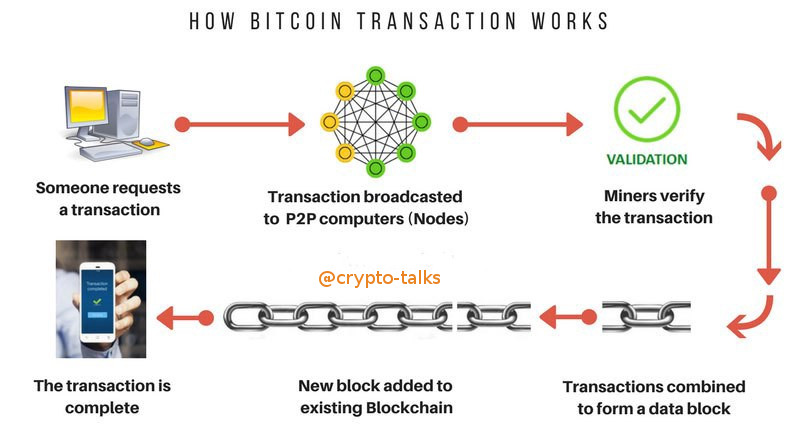

The Basics Of Bitcoin Transactions

Bitcoin transactions are conducted peer-to-peer, without any need for intermediaries. The transactions are verified and grouped into blocks which form the blockchain. Each transaction is secured with digital signatures, ensuring its authenticity and integrity.

Mining And The Proof-of-work Concept

Bitcoin functions through a process called mining, which involves miners solving complex mathematical puzzles to validate transactions. These miners play a crucial role in securing the blockchain by verifying and adding new blocks to the network. Through the proof-of-work concept, miners compete to find the correct solution and earn rewards in the form of bitcoins. This process helps maintain the integrity and security of the entire Bitcoin network.

Bitcoin Wallets

Bitcoin Wallets: When it comes to understanding wallets, it’s important to know the types of wallets and the significance of private keys. Types include software, hardware, and paper wallets, each with its unique features. Private keys are crucial for accessing and managing one’s Bitcoin funds securely. They are used to sign transactions and provide ownership of the coins. Understanding the role of private keys is essential for safeguarding cryptocurrencies.

Security And Anonymity In Bitcoin Transactions

Bitcoin transactions offer a high level of security and anonymity. Address privacy plays a crucial role in safeguarding user information. When making a transaction, Bitcoin users do not need to reveal their personal details. Instead, they use unique addresses that safeguard their privacy. These addresses are not linked to any personal identifying information, making it difficult for others to trace the transactions back to the individuals involved.

Transaction security is another key aspect of Bitcoin’s underlying architecture. Every transaction is protected by cryptographic algorithms, ensuring the integrity of the transaction data. This makes it virtually impossible for anyone to alter or tamper with the transaction once it is confirmed on the blockchain.

The pseudonymous nature of Bitcoin further contributes to its security. While transactions are recorded on a public ledger, users are identified by their digital wallet addresses rather than their real names. This pseudonymity provides an additional layer of privacy and protection.

Scalability Challenges And Solutions

Bitcoin’s scalability has been a topic of ongoing debate within the cryptocurrency community. Two proposed solutions to address this issue are Segregated Witness (SegWit) and the Lightning Network.

- Segregated Witness (SegWit): This solution separates signature data from transaction data, resulting in increased block capacity. By removing the signature data from the base transaction block, more transactions can be included in each block, improving overall scalability.

- Lightning Network: This off-chain scaling solution enables faster and cheaper transactions by leveraging payment channels. It establishes a network of interconnected channels between users, allowing transactions to occur without each one needing to be recorded on the blockchain. This reduces congestion and improves scalability.

Both SegWit and the Lightning Network provide potential solutions for Bitcoin’s scalability challenges. These advancements aim to increase transaction capacity and improve efficiency within the blockchain network, facilitating wider adoption and usability of cryptocurrencies like Bitcoin.

The Future Of Bitcoin

Bitcoin works under the hood by utilizing a decentralized network of computers to verify and record transactions. This process, known as mining, involves solving complex mathematical puzzles to add new blocks to the blockchain. Regulatory considerations play a crucial role in shaping the future of Bitcoin, impacting its legality and acceptance. The cryptocurrency’s adoption and mainstream use continue to evolve, with more businesses and individuals embracing it as a form of payment and investment. Furthermore, emerging technologies such as the Lightning Network and Segregated Witness are enhancing the scalability and privacy of Bitcoin transactions, further influencing its future trajectory.

Frequently Asked Questions For How Bitcoin Works Under The Hood

How Does Bitcoin Work?

Bitcoin is a decentralized digital currency that allows peer-to-peer transactions. It operates on blockchain technology, where transactions are recorded in blocks. Miners verify transactions and add them to the blockchain through complex mathematical calculations. This ensures security and prevents double-spending of bitcoins.

What Is The Significance Of Blockchain In Bitcoin?

Blockchain is a decentralized ledger technology that plays a crucial role in Bitcoin. It ensures transparency, security, and immutability of transactions. Each transaction is stored in a block that is linked to previous blocks, creating a chain. This eliminates the need for intermediaries, such as banks, and provides a trustless and efficient system for Bitcoin transactions.

How Can I Acquire Bitcoins?

There are several ways to acquire Bitcoins. You can buy them on cryptocurrency exchanges using traditional currency or trade goods and services for Bitcoin. Another option is mining, where you can use specialized hardware to solve complex mathematical problems and earn newly minted Bitcoins.

Additionally, you may receive Bitcoins as a form of payment from others.

Is Bitcoin A Safe Investment?

As with any investment, Bitcoin carries risk. Its value can be volatile due to various factors such as market demand and regulatory changes. However, Bitcoin has shown significant growth over the years and has gained mainstream acceptance. It is important to do thorough research, diversify your investments, and consider your risk tolerance before investing in Bitcoin.

Conclusion

Understanding the inner workings of Bitcoin gives us a glimpse into the future of finance. By delving into its decentralized nature and blockchain technology, we uncover its potential to revolutionize transactions. With a strong foundation in cryptographic principles, Bitcoin stands as a secure and transparent digital currency, poised to shape the financial landscape.