Crypto prices can be dramatically affected by major events such as market crashes, resulting in significant fluctuations. While there is a possibility that crypto will crash alongside the stock market, there is also a chance that it may not be as heavily affected, as crypto operates independently from traditional financial systems.

Despite its volatility, the cryptocurrency market has gained popularity and widespread adoption globally. Despite experiencing significant fluctuations and crashes in the past, crypto has proven to be more resilient due to its decentralized nature. Many experts believe that the chances of crypto crashing alongside the stock market are high, while others argue that it’s independent nature may protect it from such crashes.

This article explores the likelihood of crypto crashing with the stock market and the potential ramifications.

Why Crypto Crashes During Stock Market Crashes

Crypto crashes during stock market crashes because they are often viewed as high-risk investments. Crypto markets don’t have circuit breakers like traditional financial exchanges, making them more susceptible to sudden drops. While it’s not certain if crypto will crash with the stock market, it’s important to diversify one’s investments during times of market volatility.

Crypto and stock markets are related to some extent. During a stock market crash, investor confidence lowers, leading to selling pressure. This affects the crypto market as well, causing a drop in crypto prices. Another factor that impacts the crypto market is the lack of regulation. The absence of proper regulations leads to excessive speculation, which causes crypto prices to fluctuate significantly. Furthermore, unlike traditional financial exchanges, crypto markets do not have circuit breakers.

This means that they do not automatically pause trading when prices dive too much. However, not all cryptocurrencies will suffer during a market crash. Some cryptocurrencies with strong fundamentals and use cases may survive and even thrive. It is essential to conduct proper research and due diligence before investing in cryptocurrencies.

The History Of Crypto Crashes During Stock Market Crashes

Historically, crypto has experienced crashes during stock market crashes, however, it is uncertain if the same trend will continue in the future. Major events such as exchanges or coins crashing can also greatly impact crypto prices. It’s important to navigate a potential crypto crash with careful consideration and analysis.

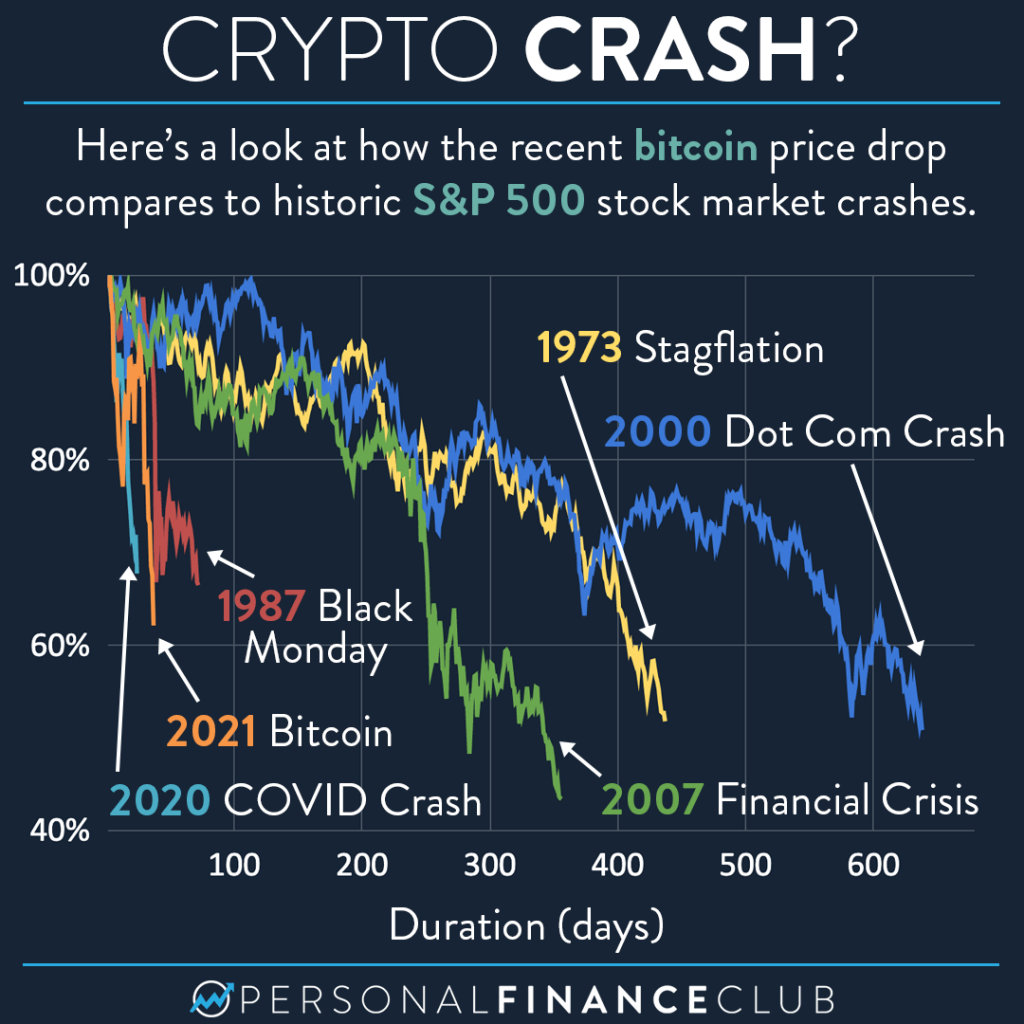

The history of crypto crashes during stock market crashes is often a topic of discussion among investors. In the past, there have been several examples of crypto crashes occurring alongside stock market crashes. For instance, in March 2020, Bitcoin fell by more than 50% when the stock market crashed due to the COVID-19 pandemic. Similarly, in December 2018, Bitcoin fell by approximately 40% when the stock market experienced a significant downturn.

However, it is important to note that not all crypto crashes coincide with stock market crashes. In some cases, crypto crashes may occur due to specific events, such as the hacking of a cryptocurrency exchange or a regulation change. As with any investment, it is essential to do thorough research and practice sound investment principles to mitigate risk.

Bitcoin In A Stock Market Crash

The impact of a stock market crash on the cryptocurrency market is unpredictable. While crypto prices can be dramatically affected by major events, such as exchanges or coins crashing, it is unclear whether a stock market crash will cause the crypto market to crash as well.

Unlike traditional financial exchanges, crypto markets don’t have circuit breakers, which automatically pause trading when prices dive too low. Thus, it is essential to navigate a crypto crash carefully.

Possible scenarios and outcomes for Bitcoin during a stock market crash are a topic of concern for many investors. History has shown that during past crashes, Bitcoin has been negatively impacted at least initially. The lack of circuit breakers in crypto markets means that there is no automatic pause in trading when prices drop too quickly. However, it is also important to note that Bitcoin has shown resilience and has recovered from past crashes with increased popularity and price.

Additionally, the Federal Reserve’s impact on stocks and crypto investments should also be considered, as changes in interest rates can impact investors’ risk appetite. Overall, it is difficult to predict the exact outcome for Bitcoin during a stock market crash, but understanding the potential impact and having a diversified investment portfolio can help navigate uncertain times.

Surviving A Crypto Crash

During a crypto crash, it’s important to identify warning signs and take proactive measures. Unlike traditional financial exchanges, crypto markets don’t have circuit breakers that automatically pause trading when prices dive too low, causing abrupt moves. Since crypto prices can be dramatically affected by major events, such as exchanges or coins crashing, it’s vital to minimize the losses. However, some cryptocurrencies may survive the crash, while others may disappear altogether.

Therefore, it’s crucial to strategize for minimizing losses during a crash by diversifying your portfolio and using stop-loss orders. Moreover, you should take precautionary steps ahead of any economic crisis, such as closely monitoring the market trends, keeping an eye on the fluctuating market indicators, and keeping a realistic expectation of the crypto’s performance. Therefore, navigating a crypto crash requires caution, proactiveness, and being alert.

Crypto To Invest In During A Stock Market Crash

Cryptocurrencies have been known to face a considerable dip during major economic downturns. However, some cryptocurrencies have shown resilience during market crashes. When investing in crypto during a market crash, some factors to consider include the cryptocurrency’s utility, adoption rate, market capitalization, and its development team.

Some cryptocurrencies that have proven to be resilient during market crashes are Bitcoin, Ethereum, Ripple, and Litecoin. These cryptocurrencies have been around for a while, and there is a solid understanding of how they operate and their potential.

When considering crypto to invest in during a market crash, it’s essential to have a good understanding of the market and its volatility. Unlike traditional financial exchanges, crypto markets don’t have circuit breakers, which automatically pause trading when prices dive too low.

Investors also need to monitor certain economic indicators, such as the federal reserve’s impact on stocks and crypto, to make informed decisions on investing in crypto during a market crash. While investing in crypto can be profitable, investors must also understand the risks involved.

The Role Of The Federal Reserve In Cryptocurrency Crashes

The Federal Reserve’s role in cryptocurrency crashes remains unclear, but events such as the stock market crashing can have a major impact on crypto prices. Cryptocurrency markets do not have circuit breakers like traditional financial exchanges, making them more susceptible to sudden drops.

However, cryptocurrency’s survival during a crash will depend on which specific currencies investors view as profitable.

Cryptocurrency prices are influenced by various factors and one of the major ones is the policies of the Federal Reserve. Interest rates have a huge impact on crypto prices as high interest rates can make investors shy away from riskier investments like cryptocurrencies and when interest rates are lowered, it can be seen as a positive for crypto. Crypto markets don’t have circuit breakers which makes them more prone to flash crashes during the market crashes.

Crypto traders and enthusiasts have been discussing the possibility of crypto surviving a market crash. While it has been predicted that some cryptocurrencies may not survive, others are expected to thrive. The exact impact of a stock market crash on crypto prices is somewhat unclear, and experts have varying opinions. Overall, the Federal Reserve’s policies and market crashes can play a significant role in the volatility of cryptocurrency prices.

Frequently Asked Questions Of Will Crypto Crash With The Stock Market

Will Crypto Be Affected If The Market Crashes?

Crypto prices can be significantly affected by major events, including market crashes. If the stock market crashes, bitcoin and other cryptocurrencies are likely to follow suit. However, it is worth noting that crypto markets do not have circuit breakers like traditional financial exchanges.

Will Crypto Crash In 2024?

It is impossible to predict whether or not crypto will crash in 2024. It can be affected by major events, such as exchanges or coins crashing. Additionally, crypto markets don’t have circuit breakers which automatically pause trading when prices dive too low.

However, if the stock market crashes, Bitcoin will likely crash along with it.

Can Bitcoin Crash To Zero?

Yes, bitcoin can crash to zero. Bitcoin’s value is driven by demand, and if the demand for it disappears, it can result in the collapse of its price to zero. However, this scenario is unlikely as it requires a global loss of trust in the currency, which is not probable given its growing adoption.

Will Crypto Ever Go Back Up?

The future of crypto is uncertain and can be affected by major events such as market crashes. While it’s difficult to predict, if the market crashes, crypto prices may go down with it. However, it’s possible that they may recover and go back up in the future.

Conclusion

When it comes to the question of whether crypto will crash with the stock market, the answer is that it’s difficult to predict with absolute certainty. However, it’s clear that major events can have a dramatic impact on crypto prices.

As the market is still relatively new and decentralized, there are unique risks and opportunities to consider. So, it’s important to approach crypto investments with caution and to stay informed about market trends. Ultimately, while there is potential for growth and profit in the crypto market, it’s important to prioritize risk management and diversification in your investment strategy.