Crypto prices change constantly, with fluctuations occurring multiple times within a day. This rapid movement is influenced by various factors such as market demand, news events, and trading volume.

Understanding how often crypto prices change is crucial for investors and traders to make informed decisions in this volatile market. Whether it’s Bitcoin, Ethereum, or other altcoins, staying updated on price movements and trends can help individuals navigate the ever-changing crypto landscape.

By being vigilant and proactive in monitoring price changes, investors can maximize their opportunities and mitigate risks in the dynamic world of cryptocurrencies.

:max_bytes(150000):strip_icc()/what-determines-value-1-bitcoin_final-15193042bd364c798609890610b53902.png)

Factors Influencing Crypto Price Changes

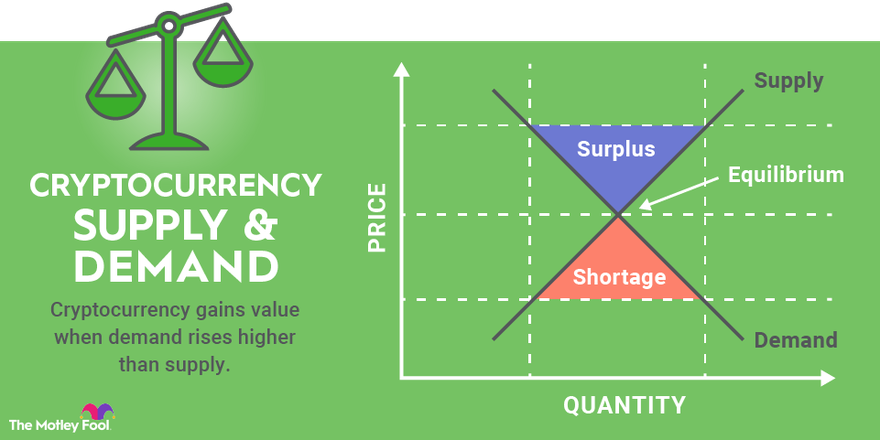

Crypto prices change frequently due to various factors. Market demand and supply play a crucial role in determining the price volatility of cryptocurrencies. Additionally, news and events related to the crypto market can have a significant impact on price shifts. Moreover, regulations imposed by governments and regulatory bodies can influence price changes. Furthermore, technological advancements and innovations in the crypto space can lead to rapid fluctuations in prices. Keeping track of these factors is essential for understanding the frequency and reasons behind crypto price changes.

Volatility In Crypto Prices

Crypto prices experience frequent changes due to their high volatility. The value of cryptocurrencies can fluctuate significantly within short periods, leading to rapid price changes. This volatility makes crypto markets highly dynamic and attractive to traders seeking potential profit opportunities.

| Crypto prices fluctuate frequently due to highly speculative nature and market manipulation. |

| Volatility in the crypto market is driven by various factors such as investor sentiment. |

| Lack of a centralized authority leads to rapid price changes in cryptocurrencies. |

| Market manipulation involves activities that can artificially inflate or deflate prices quickly. |

Frequency Of Price Fluctuations In Cryptocurrency

Cryptocurrency prices experience frequent fluctuations due to market demand and supply dynamics. Price changes occur rapidly in the crypto market, driven by various factors such as news, investor sentiment, and market trends. Being highly volatile, crypto prices can shift multiple times in a single day, making it crucial for traders to stay updated with the latest market movements.

| Frequency of Price Fluctuations in Cryptocurrency |

| Intraday price movements are common in crypto markets. |

| Daily price variations can be significant in cryptocurrencies. |

| Weekly market swings often impact crypto prices. |

The Impact Of Market Sentiment On Price Changes

Crypto prices change frequently due to various factors. Market sentiment plays a crucial role. The Fear and Greed Index gauges investor sentiment, influencing price movements. Additionally, social media can impact market sentiment, causing rapid price fluctuations. Investor sentiment surveys also provide valuable insights into price changes. Understanding the relationship between market sentiment and crypto price fluctuations is essential for investors to make informed decisions.

Short-term Vs. Long-term Price Movements

Cryptocurrency prices experience constant fluctuations, with the market being highly dynamic. These changes occur at different frequencies, encompassing both short-term and long-term price movements. Short-term price movements refer to day-to-day price volatility, where crypto prices can undergo significant and rapid changes within a single day. This high volatility is driven by various factors, including market speculation, news events, and investor sentiments.

On the other hand, long-term market trends encompass the overall direction that cryptocurrency prices take over an extended period. These trends provide insights into the broader market sentiment, adoption rates, and fundamental factors influencing the value of cryptocurrencies. By understanding the distinction between short-term price movements and long-term market trends, crypto enthusiasts and investors can gain valuable insights into the nature and dynamics of crypto price changes.

Reasons For Immediate Crypto Price Changes

Trading Volume and Liquidity: The crypto market is highly sensitive to changes in trading volume and liquidity. Large trading volumes can lead to significant price fluctuations as buyers and sellers enter the market. Additionally, low liquidity can cause prices to change rapidly due to the limited availability of buyers or sellers.

Buy or Sell Pressures: Crypto prices can also change quickly due to buy or sell pressures in the market. When there is an influx of buyers, the demand for a particular cryptocurrency increases, driving the price up. Conversely, when there is a surge in sellers, the increased supply can push the price down.

Algorithmic Trading and Bots: Algorithmic trading strategies and bots have become increasingly common in the crypto market. These programs can execute trades automatically based on predefined conditions, which can result in rapid price changes. When numerous bots are simultaneously executing trades, it can amplify the price volatility.

Frequently Asked Questions For How Often Does Crypto Price Change

How Often Does The Price Of Cryptocurrency Change?

The price of cryptocurrency changes constantly, as it is influenced by various factors such as market demand, supply, news events, and investor sentiment. The crypto market is highly volatile, with prices fluctuating every second. Traders and investors closely monitor price movements to make informed decisions.

What Are The Main Factors That Affect The Price Of Cryptocurrency?

The price of cryptocurrency is affected by factors such as market demand, regulations, technological advancements, investor sentiment, macroeconomic trends, and news events. For example, positive news about a cryptocurrency’s adoption or partnerships can drive up its price, while negative news can cause a decline.

Is It Possible To Predict Cryptocurrency Price Changes?

While it is not possible to predict cryptocurrency price changes with 100% accuracy, various tools and techniques can help traders and investors make informed decisions. Technical analysis, fundamental analysis, market sentiment analysis, and historical price data are some of the tools used to assess potential price movements.

However, it’s important to note that the crypto market is highly volatile and unpredictable.

Conclusion

In a dynamic crypto market, prices fluctuate frequently. It’s crucial to stay updated and adapt to the rapid changes in cryptocurrency pricing. By understanding these fluctuations, investors can make well-informed decisions and take advantage of opportunities as they arise. With constant monitoring and analysis, one can navigate the ever-changing world of crypto prices effectively.