Crypto is not inherently safer than stocks; both involve different risks and potential rewards. Understanding each market’s intricacies is crucial for making informed decisions.

Cryptocurrency and stock investments are met with varied levels of volatility, regulatory oversight, and market maturity. Engaging with the stock market, you’re dealing with well-established entities with historical performance data and regulatory frameworks. In contrast, the crypto space thrives on its relative novelty, offering innovative financial products tied to blockchain technology.

Traders often perceive crypto as a higher-risk, possibly higher-reward investment due to its dramatic price fluctuations. The decentralized nature of cryptocurrencies can also introduce security concerns, such as the risk of hacking and lack of consumer protections. Stock investors rely on in-depth company analysis and robust legal structures to mitigate risk. Before investing in either, it’s essential to conduct thorough research, assess your risk tolerance, and consider diversifying your portfolio to balance potential risks against prospective gains.

The Rise Of Cryptocurrency

The world of investment has seen a significant shift with the introduction of cryptocurrency. This digital asset offers a new way to handle money. It operates on technology called blockchain, which tracks all changes. This makes every transaction secure and transparent.

Comparing crypto to traditional finance shows differences in how each works. Stocks connect to companies and their performance. Crypto value often ties to different factors like tech changes or investor interest. This can mean big price changes in short times.

Table 1 presents how crypto differs from traditional finance:

| Crypto | Stocks |

|---|---|

| Runs on blockchain | Linked to company success |

| Prices can change fast | Usually more stable prices |

| Less regulation currently | Highly regulated |

People see crypto as a fresh option for putting their money to work. Yet, it’s still new and can be hard to understand. As with all investments, risks are there. But for some, these new digital coins are worth it.

Stock Market Dynamics

The stock market has years of data. Long-term investments often grow steadily here. Stocks can rise or fall. Understanding patterns is key.

Volatility means prices change fast. Stocks have ups and downs daily. Smart choices matter in the stock market.

Crypto Versus Stocks: Risk Factors

Cryptocurrencies and stocks are different in how their markets move. The value of crypto can change fast in a short time. This makes them very volatile. People must be careful and know this. You could gain or lose money quickly.

The rules for crypto are not the same everywhere. Some places have strong rules. Other places do not. Stocks usually have more rules. This helps to keep your money safer.

With crypto, the risk comes from the tech side, too. Hackers might steal digital coins. Or a computer mistake could happen. Stocks don’t often face these tech troubles. But tech can still affect them in other ways.

Security Measures In Place

Encryption serves as a robust security wall for cryptocurrencies. Each transaction on the blockchain is secured with complex codes. This digital ledger is virtually tamper-proof. Decentralization means no single point of failure exists.

Stock markets operate under stringent regulations. These rules help protect investors. The Securities and Exchange Commission (SEC) oversees these regulations. They aim to prevent fraud and promote fair trading.

Investment Myths Debunked

Many believe cryptocurrencies offer a higher level of security compared to stocks. This belief can be misleading. Stocks are backed by companies’ assets and earnings, providing a level of transparency. Contrastingly, cryptos often lack transparency. Hackers and market volatility can pose threats to crypto investments.

Discussing diversification, experts tout it as a way to spread risk. Stocks and crypto markets behave differently. Diversifying across both asset classes might reduce risk. Still, this strategy doesn’t guarantee safety. Each market has unique challenges. Thus, investors must research and understand the risks associated with both stocks and cryptocurrencies.

“`

Please note that this response is intended to provide a simulated HTML content example for the provided subheadings and adheres to the guidelines given. It is important to ensure that content is factual and relevant when creating actual SEO content.

The Liquidity Argument

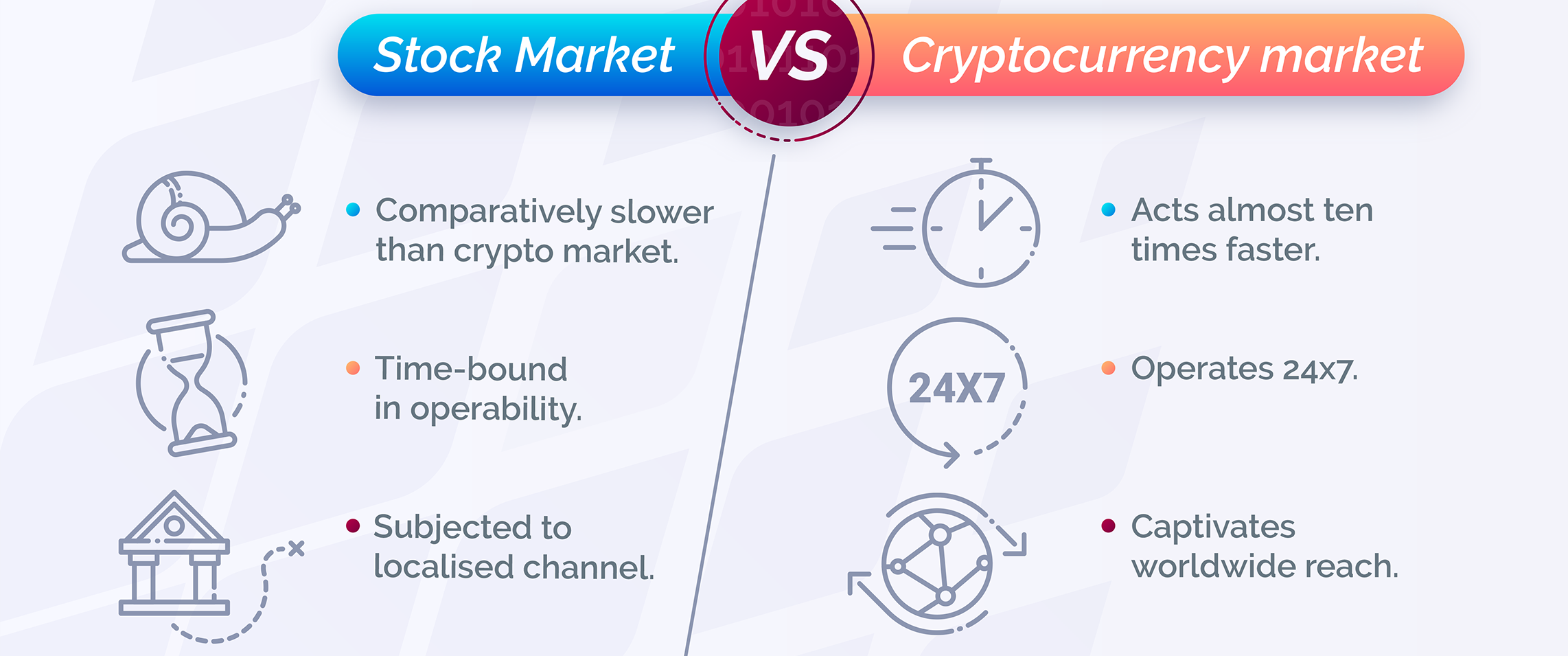

Trading crypto is often easier than selling stocks. Crypto markets operate 24/7, offering constant access to traders.

Stocks, on the other hand, are tied to stock exchanges with set trading hours. This can delay liquidation.

| Crypto Trading | Stocks Liquidation |

|---|---|

| Accessible anytime | Limited by market hours |

| Quick transactions | May face settlement delays |

| No middlemen | Often involves brokers |

Long-term Stability And Growth

Long-term stability and growth often attract investors to the stock market. The stock market shows patterns. These patterns help us see how stocks may do in the future. Historically, stocks have gone up over many years. This makes people trust the market for saving money.

Cryptocurrency is newer and harder to guess. Without a long history, crypto can change quickly. Prices can go up or down fast. This can be risky. Some experts think crypto may become more stable as it grows older.

Making Informed Investment Choices

Understanding the risks and potential of your investments is key.

Thorough research forms the cornerstone of wise investment choices.

For crypto and stocks, facts and historical data guide decision-making.

Portfolio management strategies differ between crypto and stocks.

Stocks often come with company reports and market analysis.

Crypto demands a grasp of blockchain trends and regulatory changes.

- Diversify investments to spread risk.

- Balance your portfolio with a mix of high and low-risk assets.

- Stay updated with market news for informed decisions.

:max_bytes(150000):strip_icc()/how-to-invest-in-bitcoin-391272-final-c7c727744bf44df08ac11afb5fb64fe3.jpg)

Frequently Asked Questions On Is Crypto Safer Than Stocks

Is Crypto Investment Riskier Than Stocks?

Investing in crypto can be riskier than stocks due to higher volatility. Cryptocurrencies often see sharp price fluctuations, influenced by market sentiment and news. Unlike stocks, they are also less regulated, adding to the potential risk.

What Determines Crypto’s Safety Compared To Stocks?

Crypto safety is influenced by market volatility, regulatory oversight, and technological security. Stocks generally have established regulatory frameworks, reducing certain risks. Cryptocurrencies’ safety largely depends on security measures and market stability.

How Do Stock Market Corrections Compare To Crypto?

Stock market corrections are typically less volatile than crypto. They occur when stock prices drop by 10% from a recent high. Crypto corrections can be more dramatic, sometimes experiencing drops of 20% or more, reflecting its higher volatility.

Does Diversification Work Similarly In Crypto And Stocks?

Diversification can mitigate risk in both markets, but it functions differently. Stock portfolios can be diversified across various sectors and sizes. Crypto diversification is more complex due to the correlated nature of many cryptocurrencies.

Conclusion

Navigating financial landscapes requires informed decisions. Both crypto and stocks hold potential and risks, unique to their markets. Your personal risk tolerance, investment strategy, and market knowledge are key in choosing where to invest. Always exercise due diligence and stay updated on market trends to make the best investment choice for your portfolio.

Remember, diversification can be the wisest path to financial security.