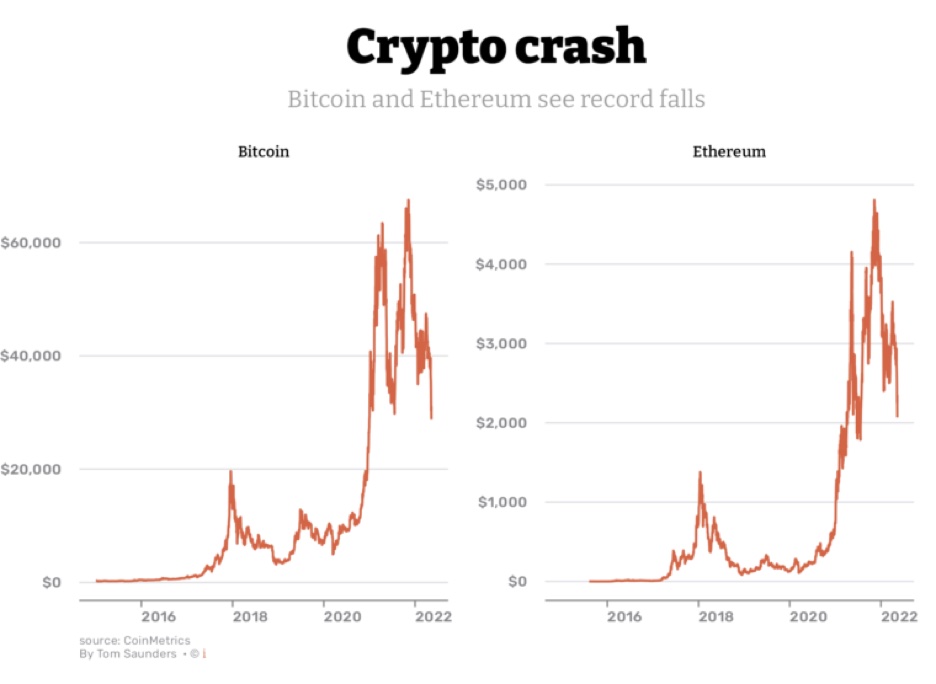

Crypto crashes occur intermittently and unpredictably in the volatile cryptocurrency market. It is challenging to predict the exact frequency of these crashes due to the market’s inherent unpredictability and rapid fluctuations.

However, history shows that significant crashes have occurred periodically, influenced by various factors such as market sentiment, regulatory events, and technological developments. Understanding the potential for these crashes is essential for investors to manage risk and make informed decisions in the crypto space.

We will explore the occurrences of crypto crashes, their implications, and strategies to navigate through market downturns successfully.

Factors Contributing To Crypto Crashes

Crypto crashes can be triggered by various factors such as market volatility, which can lead to rapid price fluctuations. Regulatory actions, such as government crackdowns or changes in legislation, also play a significant role in impacting the crypto market. Additionally, security breaches and hacking incidents can undermine investor confidence, causing abrupt market downturns. It’s important to closely monitor these contributing factors to gain a better understanding of the frequency and potential triggers of crypto crashes.

Effects Of Crypto Crashes

Cryptocurrency crashes can happen due to various reasons like regulation changes and negative news. Investor panic often results in rapid sell-offs causing prices to drop significantly. Market manipulation by whales can amplify the volatility in the market. Such crashes can lead to loss of confidence among investors, impacting the market sentiment. It is important for investors to diversify their portfolio and do thorough research before investing in cryptocurrencies.

How To Protect Yourself From Crypto Crashes

Protect yourself from crypto crashes by staying informed about market trends. Crypto crashes are unpredictable; however, historical data can provide insight into potential patterns. Diversifying your investments and setting stop-loss orders can help minimize losses during volatile periods.

| Protect Yourself from Crypto Crashes: |

| Diversify Portfolio: Invest in different types of cryptocurrencies to spread risk. |

| Stay Informed: Follow market news and trends to make informed decisions. |

| Set Stop-Loss Orders: Automatically sell if prices drop below a certain point. |

Frequently Asked Questions For How Often Does Crypto Crash

How Often Does Crypto Crash?

Crypto crashes can occur at any time due to various factors such as market volatility, regulatory changes, and negative news events. However, the frequency of crypto crashes is unpredictable and can range from months to years. It is important to note that while crypto crashes may be disruptive in the short term, the market has historically shown resilience and the potential for long-term growth.

Conclusion

In the volatile world of cryptocurrency, crashes are a common occurrence. However, understanding the factors behind these crashes can help investors make informed decisions. By staying informed and being mindful of market trends, one can navigate the crypto market with greater confidence.

With a strategic approach, individuals can mitigate the impact of crashes and maximize their investment potential.