There are approximately 2.7 million Bitcoins left to mine. With the growing popularity and widespread adoption of cryptocurrencies, Bitcoin has become a hot topic.

As the first decentralized digital currency, Bitcoin has a limited supply of 21 million coins. However, not all of these have been mined yet. Bitcoin mining refers to the process of validating transactions and adding them to the blockchain, and miners are rewarded with new Bitcoins for their computational efforts.

So far, around 18. 3 million Bitcoins have been mined, leaving approximately 2. 7 million left to be mined. With each passing year, the rate of Bitcoin production decreases, making the remaining Bitcoins scarcer. This scarcity contributes to the value and allure of Bitcoin as a digital asset.

The Basics Of Bitcoin Mining

Bitcoin mining is the process by which new bitcoins are created and transactions are verified and added to the blockchain. But what exactly is bitcoin mining?

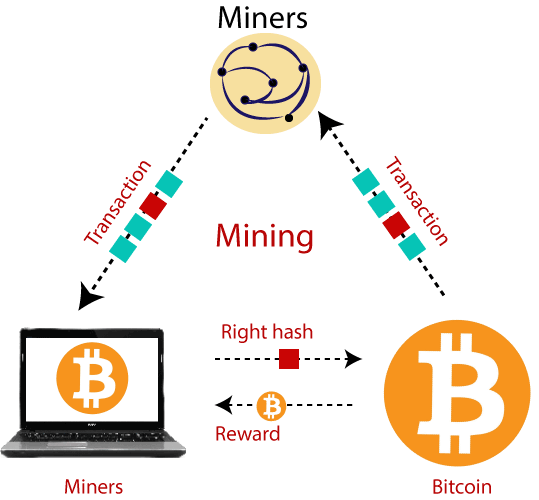

Bitcoin mining is the process of using powerful computers to solve complex mathematical problems. Miners compete to solve these problems, and the first one to find a solution is rewarded with newly minted bitcoins.

To understand how bitcoin mining works, it’s important to know that the supply of bitcoins is limited. There will only ever be 21 million bitcoins in existence. Currently, around 18.5 million bitcoins have been mined, leaving just under 2.5 million bitcoins to be mined.

The mining process involves specialized software that connects miners to the bitcoin network. Miners combine their computing power to form a mining pool, increasing their chances of solving the mathematical problem and earning bitcoins. Mining requires a significant amount of electricity and computing power, making it a resource-intensive process.

In conclusion, bitcoin mining is the process of creating new bitcoins and verifying transactions. It plays a crucial role in maintaining the security and integrity of the bitcoin network. With a limited supply of bitcoins available, mining will continue until all 21 million bitcoins are in circulation.

Understanding Bitcoin’s Limited Supply

Bitcoin’s limited supply is a fundamental aspect that contributes to its value and popularity. With a maximum supply of only 21 million bitcoins, this digital currency is designed to be scarce and decentralized. The process of mining new bitcoins involves solving complex mathematical problems, and it gradually becomes more difficult over time. This is where the concept of the Bitcoin halving comes into play.

The Bitcoin halving is an event that occurs approximately every four years, reducing the amount of new bitcoins being mined in half. This mechanism is programmed into the Bitcoin protocol to control inflation and maintain scarcity. As a result, the rate at which new bitcoins are created slows down, leading to a limited supply. The next Bitcoin halving is expected to take place in 2024, further decreasing the rate at which new bitcoins enter the market.

The limited supply of bitcoins is one of the factors that contribute to its value. With increasing demand and a finite supply, the scarcity of bitcoin drives its price upwards. Moreover, the decentralized nature of bitcoin ensures that no central authority can simply create more bitcoins, providing assurance to investors and users.

Current State Of Bitcoin Mining

The total supply of Bitcoin: Currently, there are around 18.7 million Bitcoins in circulation. The maximum supply of Bitcoin is capped at 21 million.

Projected timeline for all Bitcoins to be mined: It is estimated that the last Bitcoin will be mined around the year 2140. The mining process becomes progressively more challenging as the number of Bitcoins left to mine decreases.

Environmental impact of Bitcoin mining: Bitcoin mining consumes a significant amount of energy, leading to concerns about its environmental impact. Miners are constantly seeking more energy-efficient methods to sustainably mine Bitcoin.

Challenges And Opportunities

Bitcoin’s scarcity is a driving factor for the mining process. The decreasing supply of Bitcoin leads to increased demand. Miners consume significant energy, raising concerns. This affects Bitcoin’s pricing and stability. Addressing energy consumption is crucial. Strategies are needed to balance mining efficiency with environmental responsibility.

The Future Of Bitcoin Mining

With a limited number of bitcoins yet to be mined, the future of bitcoin mining holds increasing significance. As the supply dwindles, the mining process becomes more challenging, demanding advanced technology and expertise. This scarcity is driving up the value of the digital currency, making it an attractive investment.

The future of Bitcoin mining is key to understanding how many Bitcoins are left to mine. Technological advancements are shaping the landscape, affecting mining dynamics and potential future shifts.

Frequently Asked Questions Of How Many Bitcoin Left To Mine

How Many Bitcoins Are Left To Mine?

Currently, there are approximately 2. 6 million Bitcoins left to mine out of the total supply of 21 million. The supply decreases over time as new Bitcoins are mined through a process called halving, which occurs every four years.

Is Bitcoin Mining Still Profitable?

Bitcoin mining can be profitable depending on factors like electricity costs, mining hardware efficiency, and Bitcoin’s market price. It requires significant initial investment and ongoing operational costs, so thorough research and planning are essential to determine its profitability.

What Happens When All Bitcoins Are Mined?

Once all 21 million Bitcoins are mined, miners will rely on transaction fees as incentives instead of block rewards. This could impact the security and stability of the Bitcoin network, leading to changes in the dynamics of mining and the overall ecosystem.

Conclusion

In sum, the finite supply of 21 million bitcoins creates scarcity and value. As the mining process continues, the available supply diminishes, driving up demand and price. The diminishing block rewards also play a crucial role in maintaining the scarcity factor for the remaining bitcoins.

This scarcity adds a compelling dimension to Bitcoin’s allure for investors and enthusiasts alike.