Bitcoin mining rigs can be worth it depending on various factors such as electricity costs, hardware prices, and market conditions. Bitcoin mining has become a popular way for individuals to potentially earn profits in the cryptocurrency world.

However, the question remains: are bitcoin mining rigs worth the investment? Before delving into this matter, it is important to understand the basics of bitcoin mining. Mining involves solving complex mathematical problems to validate transactions and add them to the blockchain.

This process requires powerful hardware called mining rigs. We will explore whether investing in these rigs is a lucrative venture by considering key factors such as equipment costs, electricity expenses, and the volatile nature of the bitcoin market. By examining these elements, we can determine whether bitcoin mining rigs are truly worth the investment.

The Basics Of Bitcoin Mining

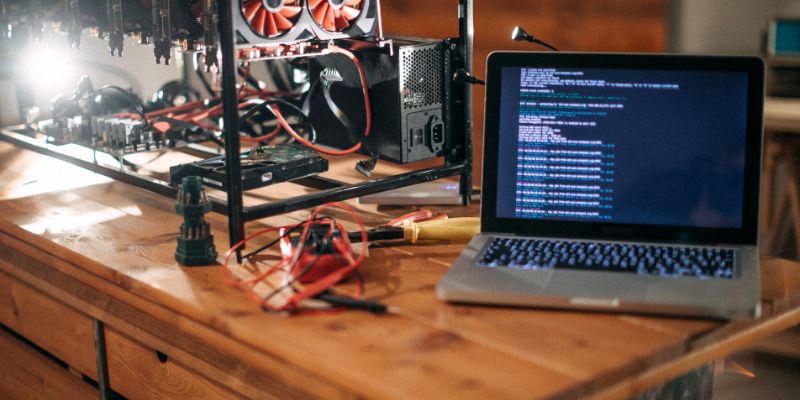

Bitcoin mining is the process of adding transaction records to the public ledger called the blockchain. This is done by solving complex mathematical problems using powerful computers known as mining rigs. These mining rigs are specifically designed to perform the necessary calculations required to mine new Bitcoins.

So, how does Bitcoin mining work? Miners compete to solve mathematical puzzles, and the first one to find a solution is rewarded with new Bitcoins. This process requires a significant amount of computational power, which is why mining rigs are necessary.

Mining rigs play a crucial role in the overall Bitcoin mining process. They consist of specialized hardware, such as graphic processing units (GPUs) or application-specific integrated circuits (ASICs), that are optimized for mining cryptocurrencies. These rigs are capable of performing the complex calculations required to validate and secure transactions on the blockchain.

While mining rigs can be costly to purchase and operate due to their high energy consumption, they can be profitable for those who have access to cheap electricity and can scale their operations. It’s important to consider factors such as hardware costs, electricity expenses, and mining difficulty when determining whether Bitcoin mining rigs are worth it.

Factors Affecting Roi

Bitcoin mining rigs can be a lucrative investment, but several factors affect their return on investment (ROI). One such factor is the cost of equipment, which includes the initial purchase and maintenance expenses. The cost of the rig, along with any additional hardware and accessories, needs to be considered against potential earnings. Electricity expenses also play a crucial role in determining ROI. Mining rigs consume a significant amount of power, so it’s essential to calculate the electricity costs accurately.

Another factor is mining difficulty and rewards. As more miners join the network, the difficulty increases, affecting the amount of Bitcoin earned. It’s important to stay updated with mining trends to estimate potential rewards accurately. So, before investing in a Bitcoin mining rig, carefully evaluate the cost of equipment, electricity expenses, and mining difficulty to gauge the overall profitability.

Calculating Potential Return

Bitcoin mining rigs can be a worthwhile investment if you carefully consider the potential return on investment (ROI). One common method for calculating ROI is to analyze the current market trends and project the future Bitcoin prices. It’s crucial to factor in the initial cost of the mining rig, as well as ongoing expenses such as electricity and maintenance. Another aspect to consider is the hash rate of the mining rig, which impacts its profitability. Ultimately, the decision to invest in a Bitcoin mining rig should be made after thorough research and careful consideration of all relevant factors.

Efficiency And Maintenance

Bitcoin mining rigs can be worth the investment if operated efficiently and maintained properly. Regular upkeep helps to maximize performance and extend the lifespan of the equipment, leading to greater profitability in the long run. Efficient systems also contribute to a sustainable mining operation, making it a worthwhile venture.

| Importance of Efficiency | Maintenance Costs |

|---|---|

| Maximizing hashing power is key for profitability. | Routine inspections are needed to prevent breakdowns. |

| Energy-efficient rigs help reduce expenses over time. | Repair costs can eat into profits if not managed. |

Risks And Challenges

Bitcoin mining rigs present potential profits but face volatility, electricity costs, and hardware maintenance challenges. Risks involve market fluctuations and technological obsolescence. Careful risk assessment is essential when considering Bitcoin mining rig investments.

Bitcoin mining rigs come with risks and challenges. Market volatility affects profitability. Regulatory changes impact operational processes. Security concerns pose potential threat to investment.

Alternative Investment Options

Investing in Bitcoin mining rigs can be a lucrative venture for those looking to diversify their investment portfolio. Cloud mining services offer a hassle-free way to earn passive income from cryptocurrency mining without the need for expensive hardware. While investing directly in cryptocurrency can yield high returns, it also carries higher risk. It’s essential to consider the volatility of the cryptocurrency market before making any investment decisions. Ultimately, the decision to invest in Bitcoin mining rigs depends on individual risk tolerance and investment goals.

Real-world Experiences

Bitcoin mining rigs have garnered mixed reviews in the real world. Many individuals have shared their success stories, highlighting the potential profitability of mining rigs. These success stories often revolve around individuals who invested in powerful mining rigs early on and witnessed substantial returns on their initial investment. However, it is essential to consider the challenges faced in the process.

One of the major challenges faced by Bitcoin miners is the increasing difficulty level of mining. As more miners join the network, the competition to validate transactions and earn rewards intensifies. This can result in diminishing profit margins and longer periods to recoup the initial investment.

Another significant concern is the cost of electricity required to power the mining rigs. Depending on the location and energy rates, electricity expenses can eat into potential earnings. It is crucial to calculate and consider these operational costs before investing in mining rigs.

In conclusion, while success stories exist, it is important to be aware of the challenges associated with Bitcoin mining rigs. Thorough research, proper cost assessment, and staying updated with market trends are vital elements to determine whether investing in mining rigs is worth it.

Final Verdict

Bitcoin mining rigs can be a worthwhile investment, but they come with their fair share of pros and cons. Before deciding whether to venture into mining, potential miners should consider a few key factors:

- Initial Investment: Mining rigs require a significant upfront investment, including the cost of the hardware, electricity, and cooling. Calculating the breakeven point is essential to determine the profitability of the venture.

- Electricity Costs: Mining cryptocurrencies like Bitcoin is energy-intensive, resulting in high electricity bills. Miners need to assess the local electricity rates to determine the impact on their profits.

- Technological Advancements: The constant evolution of mining technology can quickly render older rigs obsolete, reducing their efficiency and profitability.

- Market Volatility: The value of Bitcoin and other cryptocurrencies fluctuates significantly. Miners should be prepared for market volatility and its effect on their mining rewards.

- Mining Pools vs. Solo Mining: Joining a mining pool can provide more consistent returns, but it also means sharing the rewards with other participants. Some miners prefer solo mining for a chance at higher rewards, although it may not be as consistent.

Considering these factors, potential miners need to carefully weigh the pros and cons before deciding if Bitcoin mining rigs are worth the investment. It is essential to conduct thorough research and stay up-to-date with the latest trends in the industry to make an informed decision.

Frequently Asked Questions Of Are Bitcoin Mining Rigs Worth It

Are Bitcoin Mining Rigs Profitable In 2022?

Bitcoin mining rigs can still be profitable in 2022 if you consider factors like electricity costs, mining difficulty, and market volatility. It’s essential to conduct thorough research and calculate potential returns before investing in a mining rig.

How Much Does It Cost To Set Up A Bitcoin Mining Rig?

The cost of setting up a Bitcoin mining rig varies based on factors like hardware specifications, electricity expenses, and location. Generally, you can expect to spend anywhere from a few hundred to several thousand dollars on equipment and setup.

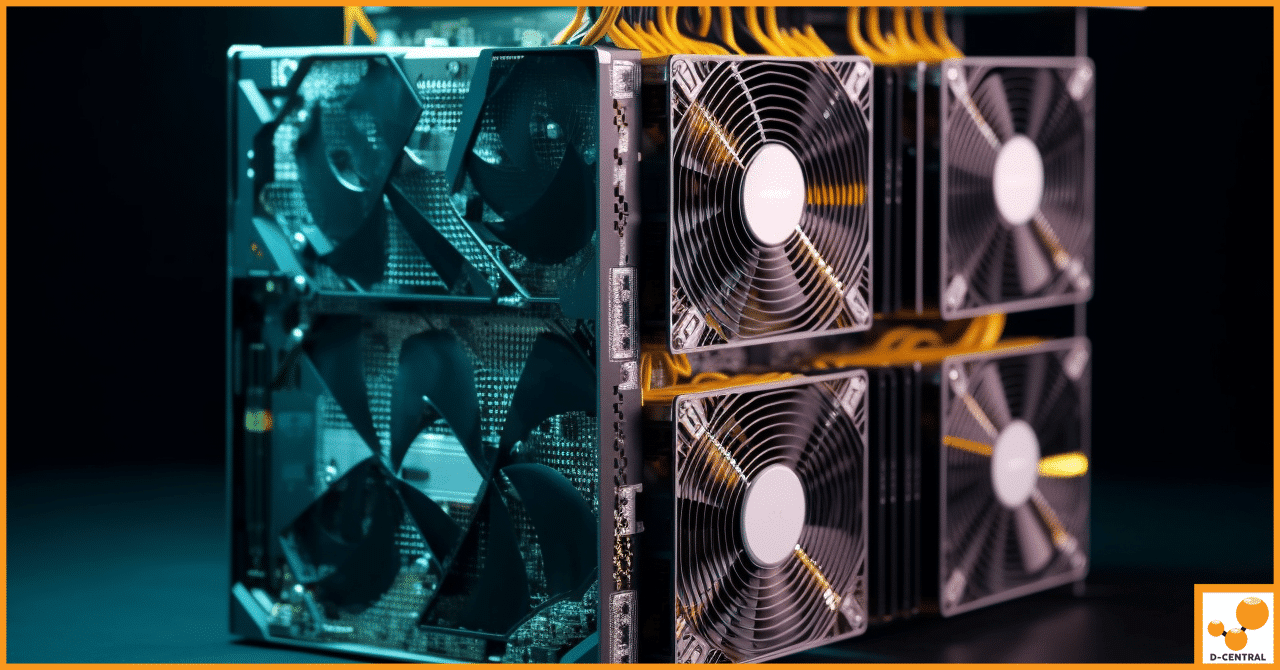

What Are The Best Bitcoin Mining Rigs For Beginners?

For beginners, popular Bitcoin mining rigs include Antminer S19, Whatsminer M30S, and Avalonminer 1246. These rigs offer a good balance of hashing power, energy efficiency, and ease of use, making them suitable choices for those new to mining.

Conclusion

The profitability of Bitcoin mining rigs depends on various factors such as electricity costs, equipment expenses, and market fluctuations. It’s crucial to carefully evaluate the current market trends and consider the long-term potential before investing in mining rigs. With the right strategy and planning, mining rigs can be a lucrative investment in the ever-evolving world of cryptocurrency.