Bitcoin ETFs work by allowing investors to gain exposure to Bitcoin through traditional brokerage accounts. These ETFs track the price of Bitcoin.

Cryptocurrency has gained popularity in the financial markets, with Bitcoin being the most well-known. Investors seeking to capitalize on Bitcoin’s potential without directly owning the digital currency can turn to Bitcoin ETFs as a convenient investment option. Through a regulated exchange, investors can buy and sell shares of the ETF, which in turn holds Bitcoin as its underlying asset.

This grants investors the opportunity to participate in Bitcoin’s price movements without the complexities of owning and storing the digital currency. The structure of Bitcoin ETFs integrates the advantages of traditional financial instruments with exposure to the burgeoning cryptocurrency market.

What Are Bitcoin Etfs?

Bitcoin ETFs are exchange-traded funds that track the price of Bitcoin and can be traded on stock exchanges. They allow investors to gain exposure to Bitcoin without actually owning it. Unlike traditional ETFs, Bitcoin ETFs are backed by Bitcoin rather than physical assets or stocks, and their value is directly linked to Bitcoin’s price movements. This makes them a convenient and regulated option for investors who want to invest in Bitcoin through their brokerage account.

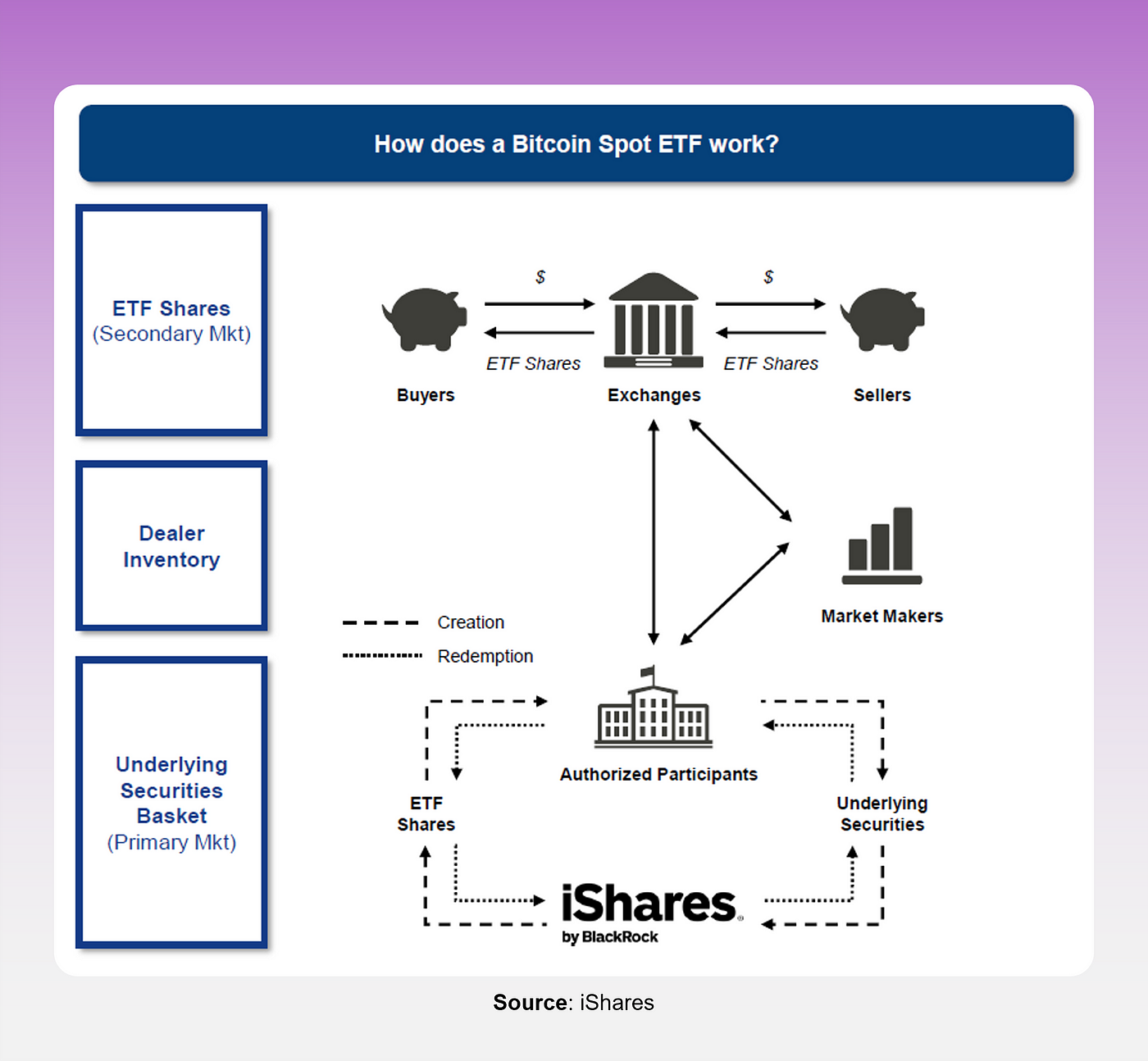

Understanding The Structure Of Bitcoin Etfs

Bitcoin ETFs allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

Creation and Redemption Process: Authorized participants create or redeem ETF shares based on demand.

Custody and Security: Bitcoin holdings are stored securely with qualified custodians to ensure safety.

Benefits Of Bitcoin Etfs

Bitcoin ETFs offer a convenient way for investors to gain exposure to the cryptocurrency market without directly owning Bitcoin. They work by tracking the price of Bitcoin and are traded on traditional stock exchanges. This provides investors with the benefits of diversification and liquidity in a regulated environment.

| Benefits of Bitcoin ETFs: |

| 1. Increased Accessibility: Bitcoin ETFs make investing in Bitcoin easier for everyday investors. |

| 2. Regulated and Transparent: ETFs provide a regulated and transparent way to invest in Bitcoin. |

Risks And Challenges Of Bitcoin Etfs

Bitcoin ETFs work by allowing investors to gain exposure to Bitcoin without directly owning the cryptocurrency. They trade on the stock exchange and their value is based on the price of Bitcoin. However, they also come with risks and challenges. Market volatility and potential price manipulation can significantly impact the performance of Bitcoin ETFs. In addition, the security and hacking risks associated with digital assets pose a potential threat to investors’ holdings. As a result, it is essential for investors to carefully consider these factors before investing in Bitcoin ETFs.

The Role Of Exchanges In Bitcoin Etfs

Bitcoin ETFs rely on exchanges to facilitate trading and provide liquidity to investors. These exchanges play a crucial role in determining the price of the ETF shares and enabling efficient buying and selling of the underlying assets. By working with exchanges, Bitcoin ETFs can offer investors exposure to the cryptocurrency market through a regulated and familiar investment vehicle.

How Do Bitcoin ETFs Work?

Bitcoin ETFs (Exchange-Traded Funds) are investment vehicles that allow investors to gain exposure to the price movements of Bitcoin without directly owning the cryptocurrency. These ETFs work by tracking the performance of Bitcoin or a group of Bitcoin-related assets.

The role of exchanges is crucial in the functioning of Bitcoin ETFs. Exchanges list and trade these ETFs, providing a platform for investors to buy and sell shares. When a Bitcoin ETF is listed on an exchange, it becomes available to a wider range of investors who can easily access it through their brokerage accounts.

Listing and trading Bitcoin ETFs on reputable exchanges enhances their credibility and attracts a larger pool of investors, contributing to liquidity and price discovery. Liquidity refers to the ease of buying or selling shares without affecting the market price. Price discovery refers to the process of determining the fair value of an asset based on the supply and demand dynamics.

Overall, exchanges play an essential role in the success and functioning of Bitcoin ETFs by providing a marketplace for investors to access these investment vehicles and ensuring liquidity and price discovery.

The Impact Of Bitcoin Etfs On The Cryptocurrency Market

The introduction of Bitcoin exchange-traded funds (ETFs) has had a significant impact on the cryptocurrency market. These ETFs have not only facilitated the integration of Bitcoin into mainstream finance, but they have also influenced market sentiment and investor confidence.

Bitcoin ETFs have brought about a surge in investor interest, with more traditional and risk-averse investors now considering entering the cryptocurrency market. This increased influx of capital has led to the expansion of the overall market and boosted the price of Bitcoin.

Moreover, the introduction of these ETFs has improved investor confidence in Bitcoin as an asset class. The institutional backing provided by the ETFs has helped dispel concerns regarding security, regulation, and volatility, making it more appealing to mainstream investors.

| Benefits of Bitcoin ETFs | Impact on the Market |

|---|---|

| Facilitate mainstream adoption | Increased investor interest and capital inflows |

| Enhance investor confidence | Boosted price of Bitcoin |

| Provide institutional backing | Dispelled concerns regarding security and regulation |

In conclusion, Bitcoin ETFs have had a profound impact on the cryptocurrency market, fostering the integration of Bitcoin into mainstream finance and positively influencing market sentiment and investor confidence.

Regulatory Considerations For Bitcoin Etfs

Bitcoin ETFs work by allowing investors to gain exposure to the price movements of Bitcoin without actually owning the cryptocurrency. The SEC approval process for Bitcoin ETFs involves rigorous scrutiny of the fund’s structure, operation, and compliance with regulatory requirements. Understanding the global regulatory landscape is crucial as different countries have varying approaches to cryptocurrency regulation.

Future Outlook For Bitcoin Etfs

Bitcoin ETFs offer investors a promising future as they provide a way to trade bitcoins on regular stock exchanges. These funds work by tracking the price of bitcoin and allow investors to gain exposure to the cryptocurrency without having to directly purchase and store it themselves.

| How Do Bitcoin ETFs Work |

| Future Outlook for Bitcoin ETFs |

| Potential Growth and Adoption |

| Bitcoin ETFs function like stock investments, tracking price movements. |

| They offer a regulated way to invest in digital currency. |

| Emerging Trends and Innovations |

| Increased acceptance in the financial mainstream is expected. |

| New technologies might enhance efficiency in ETF operations. |

Frequently Asked Questions For How Do Bitcoin ETFs Work

How Do Bitcoin ETFs Work?

Bitcoin ETFs work by allowing investors to buy shares that represent ownership of bitcoin without having to directly own or store the cryptocurrency. They function like traditional exchange-traded funds, tracking the price of bitcoin and providing investors with exposure to its price movements.

This makes investing in bitcoin more accessible and convenient for individuals and institutions alike.

Why Are Bitcoin ETFs Popular?

Bitcoin ETFs are popular because they offer investors a regulated and convenient way to gain exposure to bitcoin. They provide a bridge between the traditional financial world and the cryptocurrency market, allowing investors to tap into the potential gains of bitcoin without directly owning it.

Additionally, Bitcoin ETFs can offer diversification benefits and are accessible through existing brokerage accounts.

What Are The Advantages Of Bitcoin ETFs?

Bitcoin ETFs have several advantages. Firstly, they provide a regulated and transparent investment vehicle for gaining exposure to bitcoin. They also offer convenience, as investors can buy and sell shares of the ETF through their brokerage accounts. Additionally, ETFs allow for diversification, minimizing risk by spreading investments across multiple assets.

Lastly, ETFs provide liquidity, meaning investors can enter and exit positions easily.

Are Bitcoin ETFs Safe To Invest In?

Investing in Bitcoin ETFs carries some risks. The price of bitcoin can be highly volatile, leading to potential losses for investors. Additionally, the cryptocurrency market can be prone to hacks and fraud, posing security risks for ETFs holding bitcoin. However, the SEC approval process and regulatory oversight aim to mitigate these risks.

Investors should carefully consider their risk tolerance and conduct due diligence before investing in Bitcoin ETFs.

Conclusion

In the ever-evolving landscape of financial investment, Bitcoin ETFs have gained prominence. Understanding how Bitcoin ETFs work can provide opportunities for investors to diversify their portfolios and capitalize on the potential of digital assets. With their unique structure, Bitcoin ETFs offer a simplified and regulated means of accessing the cryptocurrency market, making them an attractive option for both seasoned and novice investors.