Upcoming cryptocurrency news focuses on Ethereum’s merge and Bitcoin ETF approvals. Investors eagerly await regulatory decisions impacting crypto’s future.

The world of cryptocurrency is vibrant and constantly evolving, with developments that can significantly impact the market and investor strategies. Among the most anticipated upcoming news, the Ethereum network’s transition to a proof-of-stake protocol, commonly referred to as “the Merge,” signals a pivotal transformation in blockchain technology, promising enhanced efficiency and reduced energy consumption.

Simultaneously, the crypto community watches closely as governments and financial institutions consider the approval of Bitcoin Exchange-Traded Funds (ETFs), a move that could greatly facilitate mainstream investment in digital currencies. Such regulatory milestones may not only bolster market confidence but also pave the way for increased adoption of cryptocurrencies in everyday transactions. Keeping abreast of these changes is crucial for anyone involved in the dynamic digital asset marketplace.

The Pulse Of Cryptocurrency Markets

Market sentiment shapes the crypto landscape. Traders and investors alike scrutinize various indicators. These indicators hint at market trends.

Social media buzz and search trends are telltale signs. They often precede market movements. Volume spikes in trading suggest a shift in interest. Sharp price changes signal upcoming news or market reactions.

Key predictive tools include price volatility measures and momentum oscillators. They help with investment decisions. Tracking these tools can identify potential market shifts.

Major Influencers In Crypto Space

Celebrity endorsements can hugely sway public opinion in the crypto world. High-profile individuals like Elon Musk or Mark Cuban often share their views on digital currencies. With just a single tweet or comment, they might cause values to spike or plummet. Fans and investors watch these influencers closely for investment tips or market predictions.

Economic policies also play a pivotal role in shaping crypto trends. Government decisions regarding regulation or acceptance of digital currencies can influence public confidence. For instance, when a country announces the adoption of a cryptocurrency as legal tender, it tends to boost market enthusiasm.

| Influencer | Impact Type |

|---|---|

| Elon Musk | Market Volatility |

| Mark Cuban | Investment Trends |

| Government Policies | Regulatory Changes |

Technological Advancements

Blockchain technology constantly evolves, introducing groundbreaking features. These innovations promise to enhance security and scalability for cryptocurrency users. Smart contracts are set to become more sophisticated. This leap forward will enable complex decentralized applications (dApps) to run flawlessly.

On another front, quantum computing emerges as a crucial factor. Experts say it could revolutionize crypto’s security framework. Quantum-resistant encryption methods are being tested. They aim to counteract quantum-level threats. Keeping cryptocurrencies safe is more important than ever. Thanks to these advances, that task looks set to be achievable.

Regulatory Changes And Their Impact

Regulatory changes deeply impact the cryptocurrency landscape. Countries across the globe are crafting rules to govern digital currencies. These developments can affect how cryptocurrencies operate and are traded.

Understanding these new regulations is crucial for anyone involved with crypto investments. The rules vary significantly, from strict oversight to more relaxed frameworks that encourage innovation.

The aspect of taxation is also vital. Different nations are setting up tax laws for crypto transactions. This affects the profits that traders and investors can make. Being well-informed about these taxes is key to successful crypto trading.

Decentralized Finance (defi) Movements

The DeFi landscape is always growing with innovative technologies. New projects tap into uncharted territories, promising increased security and accessibility. Early adopters could potentially gain from these novel financial solutions. Excitement builds as community-driven platforms challenge traditional finance systems.

DeFi applications aim to make money matters simpler and fairer. They use blockchain to create trustless transactions. This means everyone can join without needing a big bank’s OK. Trust comes from code, not people. You always stay in control of your funds.

Considering the suitability of information representation, a table is not the most effective way to communicate these concepts. The use of paragraphs and bullet points is more appropriate for the content being discussed.

- Chain Yield: A new tool for passive earnings.

- Flexi Finance: A platform for flexible lending.

- Uniswap V3: Next-level decentralized trading.

- InsureChain: On-chain asset protection.

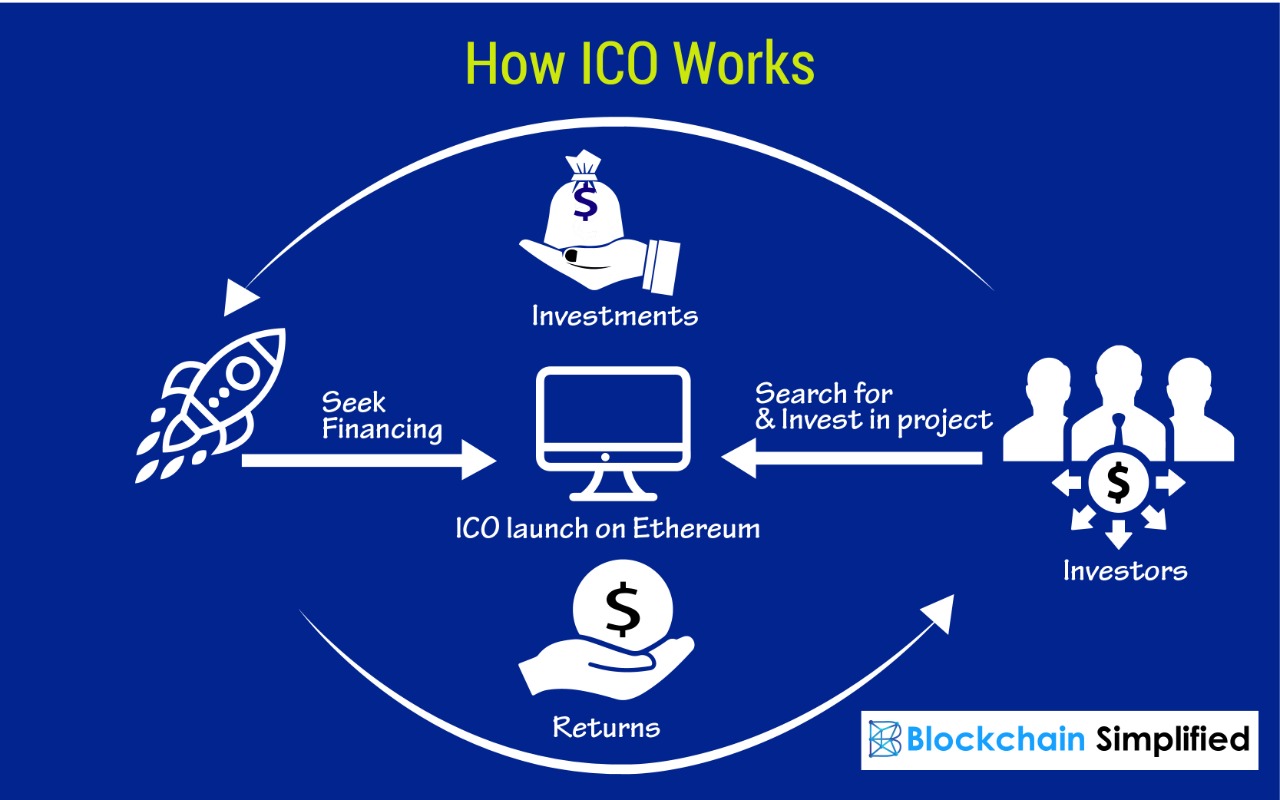

Initial Coin Offerings (ico) And Token Launches

Initial Coin Offerings (ICO) spark interest with their high investment potential.

These events provide early access to tokens. Investors can buy tokens

before they hit the market. Research is key to spotting promising ICOs. Look for

solid teams and innovative projects. Be aware of the risks, such as market volatility

and regulatory uncertainty. It’s wise to invest only what you can afford to lose.

Token launches can lead to significant gains, but due diligence is a must.

Crypto Ecosystem Collaborations

Crypto ecosystem collaborations shine a spotlight on strategic partnerships.

These alliances between blockchain entities pave the way for innovative growth and technology sharing. Partnerships are essential for new use-cases and market expansion.

Cross-chain integrations move the industry forward. They allow different blockchain networks to work together. This synergy creates a unified crypto space.

Users enjoy enhanced features and seamless asset transfers. Developers deliver richer experiences across platforms.

Together, these movements fuel cryptocurrency’s evolution and bring users value.

Nft And Digital Collectibles Outlook

The NFT marketplaces are booming, showcasing digital art, games, and collectibles. Big brands and artists are creating NFTs (Non-Fungible Tokens), driving up demand. Sites like OpenSea and Rarible let users buy, sell, or trade these unique items. Popular pieces often sell for thousands, even millions, of dollars.

Experts predict that NFTs will keep growing in value. The technology behind NFTs could change how we own things online. Smart contracts make buying art safer and more reliable. This shift suggests NFTs might become as common as online shopping. People see NFTs as the future of digital ownership and collecting.

Public Perception And Adoption

Understanding crypto acceptance is crucial. Studies show more people are learning about crypto. The trend reflects growing interest and trust in digital currencies. Recent surveys highlight a rise in crypto curiosity.

Educational resources play a key role in adoption. Simple guides and clear FAQs are vital. They help new investors make informed decisions. The availability of these resources has increased, giving rise to better-educated investors.

| Year | Investor Education Levels | Trust in Crypto |

|---|---|---|

| 2021 | Moderate | Growing |

| 2022 | High | Strengthening |

| 2023 | Very High | Established |

- The number of crypto users is soaring.

- Trust in digital currencies is climbing.

- Resources for newbies are now plentiful.

Predictive Analytics And Market Forecasting

The crypto market is rapid and unpredictable. Experts now use AI for better guessing. AI can spot patterns that humans miss. Knowing these patterns helps guess where crypto prices will go. This is key for investors.

Many online tools also help with forecasts. These tools use current data to predict future trends. Some even offer alerts on market swings. Investors must choose these tools wisely. An accurate tool can mean big wins.

| Tool Name | Features | User-Friendly |

|---|---|---|

| CryptoPredict | Real-time analysis | Yes |

| MarketWhiz | Historical data trends | No |

| TrendScanner | Email alerts | Yes |

Frequently Asked Questions On Crypto Upcoming News

What Are The Latest Trends In Cryptocurrency?

Cryptocurrency is currently witnessing an inclination towards decentralized finance (DeFi) and non-fungible tokens (NFTs). Layer 2 scaling solutions and energy-efficient consensus mechanisms like proof-of-stake are also gaining traction to address concerns around transaction speed and sustainability.

How Can Blockchain Impact Future Finance?

Blockchain has the potential to revolutionize the financial sector, particularly by enhancing transaction security and speed. It enables transparent, immutable records, and offers smart contract functionality, which could automate and streamline various financial processes, minimizing the need for intermediaries.

What’s New In Bitcoin Regulation?

Recent Bitcoin regulation news focuses on varying approaches globally, with countries like El Salvador embracing it as legal tender, while others, including China, have imposed restrictions or bans on cryptocurrency trading and mining due to financial risks and energy consumption concerns.

Are Ethereum Upgrades Affecting The Market?

Yes, Ethereum upgrades, such as the transition to Ethereum 2. 0 with its shift to proof-of-stake, are positively impacting the market. They aim to enhance network scalability, security, and sustainability, which could potentially lead to increased adoption and higher valuations.

Conclusion

As the digital currency landscape constantly evolves, staying informed is key. With the insights shared in this post, investors and enthusiasts can navigate the waves of crypto news. Keep an eye on trends, events, and updates—they shape your crypto journey and fuel informed decisions.

Don’t miss out; the next big story could redefine the market.