Invest in Bitcoin mining stocks for potential high returns. Research companies like Riot Blockchain and Marathon Digital Holdings.

Bitcoin mining stocks offer investors a chance to capitalize on the exponential growth of the cryptocurrency industry. By choosing the right stocks, investors can benefit from the increasing value of Bitcoin without directly owning the digital currency. In this guide, we will explore some of the best Bitcoin mining stocks available in the market and provide insights into how to navigate this lucrative sector successfully.

Whether you are a seasoned investor or a newcomer looking to diversify your portfolio, understanding and investing in Bitcoin mining stocks can offer significant opportunities for financial growth.

The Rise Of Bitcoin Mining

The growth of the Bitcoin mining industry has led to a surge in demand for Bitcoin mining stocks. As the popularity of cryptocurrencies continues to rise, so does the interest in investing in the companies that are behind the intricate process of mining Bitcoin and other digital currencies.

Investing in Bitcoin mining stocks can provide investors with direct exposure to the cryptocurrency market. These stocks are influenced by the price movements of Bitcoin, making them an attractive option for those looking to capitalize on the digital asset’s potential growth.

Factors To Consider When Choosing Bitcoin Mining Stocks

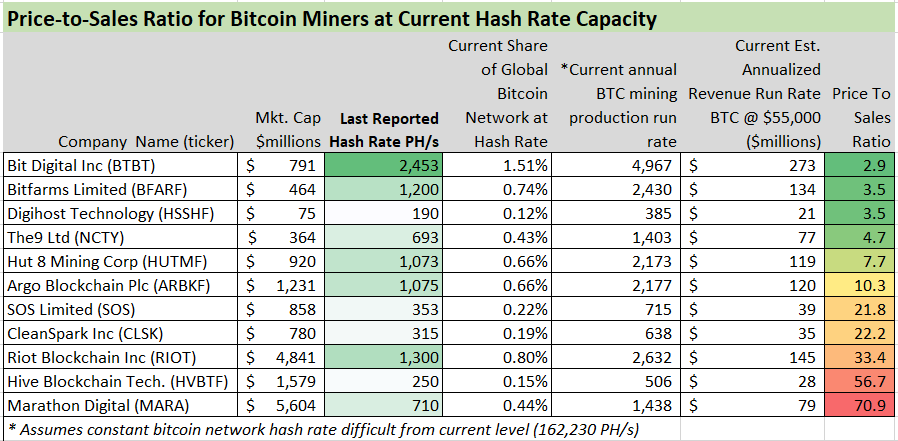

When selecting Bitcoin mining stocks, investors should assess factors like company reputation, operational efficiency, and growth potential. Conducting thorough research and monitoring market trends can help identify the best performing stocks in the cryptocurrency mining sector.

| Market Capitalization and Stability: Look for companies with strong financial backing. |

| Technology and Mining Efficiency: Efficiency boosts profitability in Bitcoin mining. |

| Regulatory Environment: Check for compliance with Bitcoin mining regulations. |

| Operational Costs and Profitability: Lower costs lead to higher profits in mining. |

| Company Reputation: Trustworthy firms ensure reliable investment choices. |

Top Bitcoin Mining Stocks To Watch

Discover top-performing Bitcoin mining stocks poised for growth and potential investment opportunities in the cryptomarket. Stay informed on leading companies driving innovation in the field. Tracking these stocks can provide insights and possibilities as the crypto industry evolves.

| Stock A: Company Overview and Performance | |

| Stock A is a leading player with robust financials and strong market presence. | The company continues to showcase impressive growth in the bitcoin mining sector. |

| Stock B: Key Features and Financials | |

| Stock B stands out with its innovative technology and solid financial performance. | The company’s strategic investments have proven to yield promising returns. |

| Stock C: Competitive Advantages and Market Position | |

| Stock C excels in market competition with its cutting-edge solutions and wide market reach. | The company’s strong market position sets it apart from its peers. |

How To Evaluate The Performance Of Bitcoin Mining Stocks

When evaluating the performance of Bitcoin mining stocks, it’s important to consider key financial metrics. Analyzing revenue and earnings growth is crucial to gauging the company’s financial health. Additionally, assessing return on investment and dividends gives insight into the company’s profitability and shareholder value. By looking at these important financial indicators, investors can make more informed decisions about the potential of Bitcoin mining stocks.

Long-term Prospects Of Bitcoin Mining Stocks

Bitcoin’s price volatility has a significant impact on the long-term prospects of Bitcoin mining stocks. The value of Bitcoin has been known to experience sharp fluctuations, which can affect the profitability of mining operations. However, despite this volatility, there are several factors that contribute to the positive outlook for Bitcoin mining stocks.

One potential impact on the industry is the upcoming Bitcoin halving event. This event, which occurs approximately every four years, reduces the block reward given to miners by 50%. While this may initially seem like a challenge for mining profitability, it is often followed by a significant increase in the price of Bitcoin, creating a favorable environment for mining stocks.

Furthermore, technological advancements and innovations in the mining sector also contribute to the long-term prospects of Bitcoin mining stocks. As mining technology improves, miners can increase their efficiency and reduce costs, leading to improved profitability.

Additionally, the emerging market opportunities for Bitcoin mining stocks are worth noting. As the adoption of digital currencies grows globally, the demand for Bitcoin mining services is likely to increase, creating new opportunities for investors.

Considering these factors, it is evident that Bitcoin mining stocks have promising long-term prospects, despite the price volatility of Bitcoin.

Risks And Challenges In Bitcoin Mining Investments

Investing in Bitcoin mining stocks presents risk and challenges due to high volatility and regulatory uncertainties. Despite potential profitability, factors like operational costs, hardware upgrades, and market fluctuations can impact returns. Selecting reputable and well-established companies with a strong track record is crucial for mitigating these risks and maximising potential gains.

Bitcoin mining investments come with certain risks and challenges that investors need to be aware of. One of the major risks is the market volatility and bitcoin price fluctuations. As the cryptocurrency market is highly volatile, the prices of bitcoin can experience sharp swings, making it difficult to predict the future value of investments. Another challenge is the regulatory uncertainty surrounding bitcoin mining. Governments around the world are still figuring out how to regulate this decentralized currency, leading to potential legal and compliance issues.

Additionally, the increasing competition and mining difficulty pose challenges for investors. As more miners join the network, the competition to solve complex mathematical problems increases, making it harder to mine new bitcoins. Lastly, there is a risk of security risks such as cyber attacks. Since bitcoin transactions are conducted online, there is always a possibility of hackers targeting mining operations, resulting in potential financial and data losses.

Diversifying Your Investment Portfolio

When considering diversifying your investment portfolio, including Bitcoin mining stocks can provide a hedge against market volatility and inflation. This strategy may offer the potential for higher returns while typically exhibiting low correlation with traditional assets, enhancing the overall stability of the portfolio. As part of your analysis, it’s important to carefully evaluate the risks and rewards associated with investing in Bitcoin mining stocks. Researching the industry dynamics and understanding the regulatory environment can help in making informed decisions about including these stocks in your investment mix.

Frequently Asked Questions For Best Bitcoin Mining Stocks

What Are The Best Bitcoin Mining Stocks To Invest In?

Investing in bitcoin mining stocks like Riot Blockchain, Marathon Patent Group, and Hut 8 Mining Corp can provide exposure to the growth potential of the crypto industry. These companies are involved in mining bitcoin and are well-positioned to benefit from the increasing adoption and price appreciation of the cryptocurrency.

How Do Bitcoin Mining Stocks Work?

Bitcoin mining stocks work by investing in companies that are involved in the process of mining bitcoin. These companies use specialized hardware and software to solve complex mathematical problems, which validate and confirm transactions on the blockchain. As a reward for their efforts, they earn new bitcoins that are added to the circulating supply.

Can I Mine Bitcoins Without Buying Mining Stocks?

Yes, you can mine bitcoins without buying mining stocks. Individuals can mine bitcoins by setting up their own mining rigs or joining mining pools, where participants combine their resources to mine more efficiently. However, mining can be resource-intensive and requires technical knowledge, so buying mining stocks can be a more accessible way to gain exposure to bitcoin mining.

Conclusion

Investing in the best Bitcoin mining stocks can be a lucrative opportunity for both beginners and seasoned investors. By diversifying your portfolio with reputable companies in the cryptocurrency mining sector, you can capitalize on the growing demand for digital assets.

Stay informed, stay cautious, and reap the rewards of this innovative market.