Cryptocurrency works in the stock market by allowing investors to buy and sell digital currencies as they would with traditional stocks. Cryptocurrency has become a buzzword in recent years, with the rise of Bitcoin and other digital currencies.

But how does it work in the stock market? Cryptocurrency trading involves buying and selling digital currencies, such as Bitcoin and Ethereum, through exchanges or trading platforms. These digital currencies are bought and sold based on their current market value, similar to how traditional stocks are traded on the stock market.

However, the technology behind cryptocurrency, known as blockchain, offers unique features such as decentralization and anonymity. Understanding how cryptocurrency works in the stock market can open up opportunities for investors looking to diversify their portfolio.

Introduction To Cryptocurrency In The Stock Market

Cryptocurrency is a digital currency that operates independently of a central bank, and it has been making waves in the stock market. It utilizes blockchain technology to maintain transparency and security, allowing investors to purchase the currency and potentially profit from its fluctuations.

| Introduction to Cryptocurrency in the Stock Market |

| Cryptocurrency is a form of digital currency that uses encryption techniques to regulate the generation of units and verify the transfer of funds. Unlike traditional currency, it is decentralized, meaning that it is not governed by any central authority such as a government or bank. Cryptocurrency has gained popularity in recent years, with many investors interested in its potential for high returns. However, it is important to understand how it works before investing. |

| Explanation of Cryptocurrency |

| Cryptocurrency operates on a decentralized ledger technology called the blockchain, which keeps a record of all transactions. Users can buy or mine cryptocurrencies and store them in digital wallets. Transactions are then verified by network nodes through cryptography. Once verified, the transaction is added to the blockchain, making it irreversible and unalterable. The value of cryptocurrencies fluctuates due to market demand and supply. This makes it highly volatile, and investors need to carefully consider the risks before investing. |

| The Relation of Cryptocurrency to the Stock Market |

| Cryptocurrency has a complex relationship with the stock market. While traditional investors may view it as a risky investment, some see it as a hedge against inflation or a potential high-return investment opportunity. Additionally, some companies may benefit from incorporating cryptocurrency into their business models. However, the volatility of cryptocurrency makes it difficult to predict how it will impact the stock market in the long term. Overall, investors should treat cryptocurrency with caution and seek professional advice before investing. |

Types Of Cryptocurrency Trading

There are different types of cryptocurrency trading in the stock market, including scalping, swing trading, arbitrage, and dollar cost averaging. To make a profit, new investors lend their cryptocurrencies to a platform for interest and cryptocurrency stocks can be traded in the same way as traditional stocks for potential gains with significant risks.

Cryptocurrency trading involves buying and selling virtual currencies. There are various types of cryptocurrency trading strategies which yield different results. Some popular strategies include scalping, swing trading, arbitrage, and dollar cost averaging.

Scalping involves making small profits from small price changes and requires a trader to be watchful and trade quickly. Swing trading, on the other hand, seeks to profit from price changes over the short to medium term. Arbitrage involves taking advantage of price differences between exchanges, while dollar-cost averaging involves buying small amounts of cryptocurrency at regular intervals regardless of the market conditions.

Knowing the types of cryptocurrency trading strategies will help you choose the most suitable one for you. Combining different strategies and diversifying your portfolio can help to minimize risks and maximize profits.

Top Cryptocurrency Research Sites And Trading Platforms

Explore the top cryptocurrency research sites and trading platforms to understand how cryptocurrency works in the stock market. CoinMarketCap, TradingView, Gecko Labs, and CoinDesk offer valuable insights into the world of cryptocurrency. Binance, Coinbase, eToro, and KuCoin are popular trading platforms, while Gemini, Bitstamp, Blockstream, HTX, Marathon Digital, and Bitfinex are well-known Bitcoin companies.

Different types of crypto trading include scalping, swing trading, arbitrage, and dollar cost averaging.

| CoinMarketCap |

| TradingView |

| Gecko Labs |

| CoinDesk |

| Binance |

| Coinbase |

| eToro |

| KuCoin |

CoinMarketCapTradingView. You can also use Gecko Labs to monitor cryptocurrency prices and market trends. CoinDesk is also a great resource for the latest news and analysis on cryptocurrency. For trading, popular platforms include BinanceCoinbaseKuCoin. It is essential to know the different types of crypto trading such as Scalping, Swing Trading, Arbitrage, and Dollar Cost Averaging.

Considering the risks that come with investing in digital currencies, it is vital to conduct thorough research before carrying out any transactions. It is also important to note that cryptocurrencies are riskier investments than traditional stocks but may also offer potential for higher returns.

Cryptocurrency Company Names

| Crypto Company Names: | |

| Gemini | Bitstamp |

| Blockstream | HTX |

| Marathon Digital | Bitfinex |

Cryptocurrency is a digital asset designed to work as a medium of exchange. Its trading and investment options are increasing rapidly in stock markets. Different crypto companies offer various services and facilities to the investors. Some popular crypto company names are Gemini, Bitstamp, Blockstream, HTX, Marathon Digital, and Bitfinex. Each company has its policies, offers, and specifications and their availability may vary from country to country. It’s wise to research thoroughly before choosing any crypto company to invest in.

How Cryptocurrency Trading Works For Beginners

Cryptocurrency trading involves buying and selling digital coins through an exchange. The market determines the value of the coins, which can fluctuate wildly, and traders can choose from different types of cryptocurrency trading such as scalping, swing trading, arbitrage, and dollar cost averaging.

It’s important for beginners to research different companies like Gemini, Bitstamp, and others, understand the risks involved, and develop a trading strategy before getting started.

Cryptocurrency trading is an exciting and rapidly growing field that can lead to profitable investments. Before diving in, there are a few necessary preparations to consider. Firstly, research various websites and publications to gain a better understanding of the market and available options. Secondly, finding the right broker is crucial, as they provide the platform for buying and selling cryptocurrencies. Once a broker is found, making the first trade is an important milestone. Remember to start small and gradually work up to larger investments while continuously learning from mistakes.

There are different types of crypto trading, such as scalping, swing trading, arbitrage, and dollar-cost averaging, each with their own advantages and risks. Finally, familiarize yourself with some established Bitcoin company names, including Gemini, Bitstamp, Blockstream, HTX, Marathon Digital, and Bitfinex. With adequate knowledge and preparation, cryptocurrency trading can be a rewarding and lucrative opportunity.

Is Cryptocurrency A Good Investment?

Investing in cryptocurrency has become popular in recent years, but its place in the stock market is still somewhat unknown. Cryptocurrencies work as decentralized, digital currencies that use blockchain technology for transactions. While the potential for high returns exists, the high volatility and inherent risks mean that investing in cryptocurrency should be approached with caution.

The cryptocurrency market is often characterized by high risk and volatility. As with any investment, there is no guarantee of success, and individuals should only invest what they can afford to lose. Before investing in cryptocurrency, it’s essential to do thorough research to understand the market, related risks, and potential rewards. Investors with a high-risk tolerance, a strong financial position, and an appetite for new technologies and markets may consider investing in cryptocurrency. Still, it’s not a good investment for everyone.

As far as making money with cryptocurrency, one way is through a “yield farming process” by lending your cryptocurrency to a platform in exchange for interest. However, interest rates solely depend on the platform and the type of cryptocurrency lent. It’s essential to keep in mind that cryptocurrency trading is not the same as traditional trading. It’s best to choose a reliable trading platform that allows access to cryptocurrency exchanges and offers essential security measures for the protection of funds.

How To Make Money With Cryptocurrency

Cryptocurrency trading in the stock market is similar to traditional stock trading, but with a focus on digital currencies. Investors can buy and sell cryptocurrency stocks through online brokerages or trading platforms. Yield farming is one way to earn interest on cryptocurrency investments by lending funds to platforms.

Like any investment, cryptocurrencies involve risk and require careful research.

| Yield Farming Process | The yield farming process involves lending cryptocurrency to a platform in return for interest. The amount of interest you gain will depend on the platform and the type of cryptocurrency you are lending. |

| Interest Rates on Platform | The interest rates offered on the platform may vary depending on the market conditions and the demand for the cryptocurrency you are lending. |

| Type of Cryptocurrency to Lend | The type of cryptocurrency you choose to lend will also determine the interest rate you receive. Some platforms offer higher interest rates for lending more popular cryptocurrencies such as Bitcoin and Ethereum. |

Investing in cryptocurrency can be a great way to earn some extra money. Yield farming involves lending your cryptocurrency to a platform in exchange for interest. The amount of interest you gain will depend on the platform and the type of cryptocurrency you are lending. Different platforms offer varying interest rates depending on market conditions and the demand for the cryptocurrency. It’s important to research and choose the right platform for lending your cryptocurrency.

Additionally, the type of cryptocurrency you choose to lend will also determine the interest rate you receive. Popular cryptocurrencies like Bitcoin and Ethereum often provide higher interest rates. However, investing in cryptocurrency is also a high-risk investment, and it’s vital to have a strong financial position and high-risk tolerance.

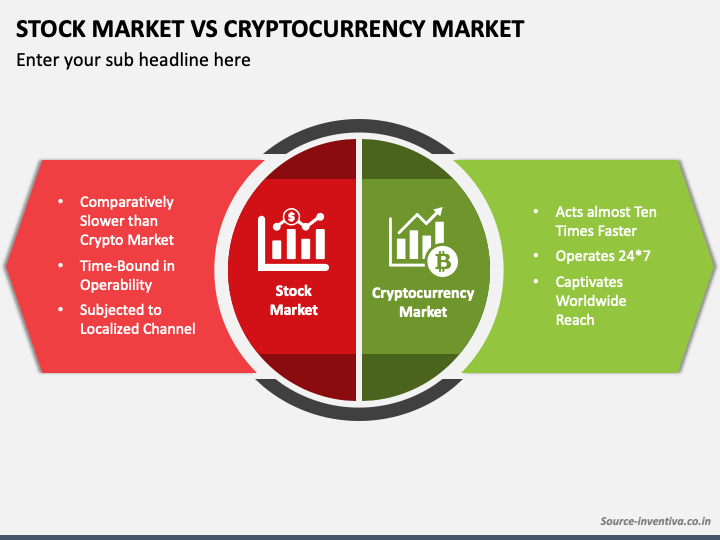

Cryptocurrency Vs. Stocks: Which Is Riskier?

While both cryptocurrencies and stocks come with risks, some argue that cryptocurrency may be riskier due to its lack of regulation and unpredictable value. In the stock market, companies have financial reports and regulations to adhere to, whereas the value of cryptocurrencies can be vulnerable to sudden changes.

However, both offer potential for growth and profits for investors.

| Key Takeaways |

| Cryptocurrency vs. Stocks: Which is Riskier? |

| – Stocks provide intrinsic value and a solid historical record of long-term returns. |

| – Cryptocurrencies may offer potential for outsized gains but come with significant risk. |

| – Successful cryptocurrency trading requires knowledge in areas such as research sites, platforms, types of trading, and Bitcoin company names. |

| – Crypto investments are generally considered high-risk and best suited for those with a high risk tolerance and financial stability. |

| – Cryptocurrency can generate interest on investments through a process called yield farming. |

Cryptocurrency and stocks are two different investment classes that come with their own set of risks and rewards. Stocks, with their intrinsic value and a history of delivering solid long-term returns, tend to be a safer option for investors. On the other hand, while cryptocurrencies may hold the potential for outsized gains, they also come with significant risk. Successful cryptocurrency trading requires knowledge in areas such as research sites, platforms, types of trading, and Bitcoin company names. Additionally, it is important to note that crypto investments are generally considered high-risk and best suited for those with a high risk tolerance and financial stability. However, cryptocurrency can generate interest on investments through a process called yield farming.

Frequently Asked Questions Of How Does Cryptocurrency Work In Stock Market

How Does Cryptocurrency Trading Work For Beginners?

Cryptocurrency trading involves buying and selling digital coins through an exchange or a CFD trading account. It’s a highly volatile and risky investment option that can yield outsized gains but also lead to significant losses. Beginners should research different trading strategies such as scalping, swing trading, arbitrage, or dollar-cost averaging.

It’s important to have a high-risk tolerance and financial stability before investing in cryptocurrencies.

Is Crypto A Good Investment?

Bitcoin and other cryptocurrencies are risky investments with high volatility. They should be considered only if you have a high risk tolerance, strong financial position, and can afford to lose some or all of your investment. Cryptocurrencies may hold potential for outsized gains but come with significant risk.

How Does Crypto Make You Money?

Crypto can make you money through a yield farming process, where you lend your cryptocurrency to a platform in exchange for interest. The amount of interest depends on the platform and the type of cryptocurrency. It is important to have a high risk tolerance and invest only what you can afford to lose.

Is Crypto Riskier Than Stocks?

Cryptocurrencies are riskier than stocks due to their significant risk. While stocks have a history of delivering long-term returns, cryptocurrencies have no intrinsic value. They may offer potentially high gains, but their volatile nature makes them risky. A broadly diversified stock portfolio is usually a safer option.

Conclusion

Cryptocurrency has become an integral part of the stock market. It operates on blockchain technology, a decentralized system that enables secure and transparent transactions. However, investing in cryptocurrency requires adequate knowledge and high risk tolerance due to its inherent volatility.

With the increasing adoption of cryptocurrency in various industries, it is important to stay informed and keep up with the market trends to make informed investment decisions.