Crypto prices differ on exchanges due to the fact that there is no centralized pricing system for cryptocurrencies, and the prices are determined based on the economic and trading factors of supply and demand. Cryptocurrencies have become one of the most volatile assets in the world, with prices changing rapidly and often varying from one exchange to another.

As a result, many people are left wondering why crypto prices differ on exchanges. The answer to this question lies in the fact that there is no regulated or centralized pricing system for cryptocurrencies. Unlike traditional assets that are traded on centralized platforms, crypto assets have multiple exchanges, and the price of a particular cryptocurrency on one exchange may not be the same as in other exchanges.

We will explore some of the main reasons why crypto prices differ on exchanges and what you should keep in mind when trading them.

Factors Contributing To Price Variations

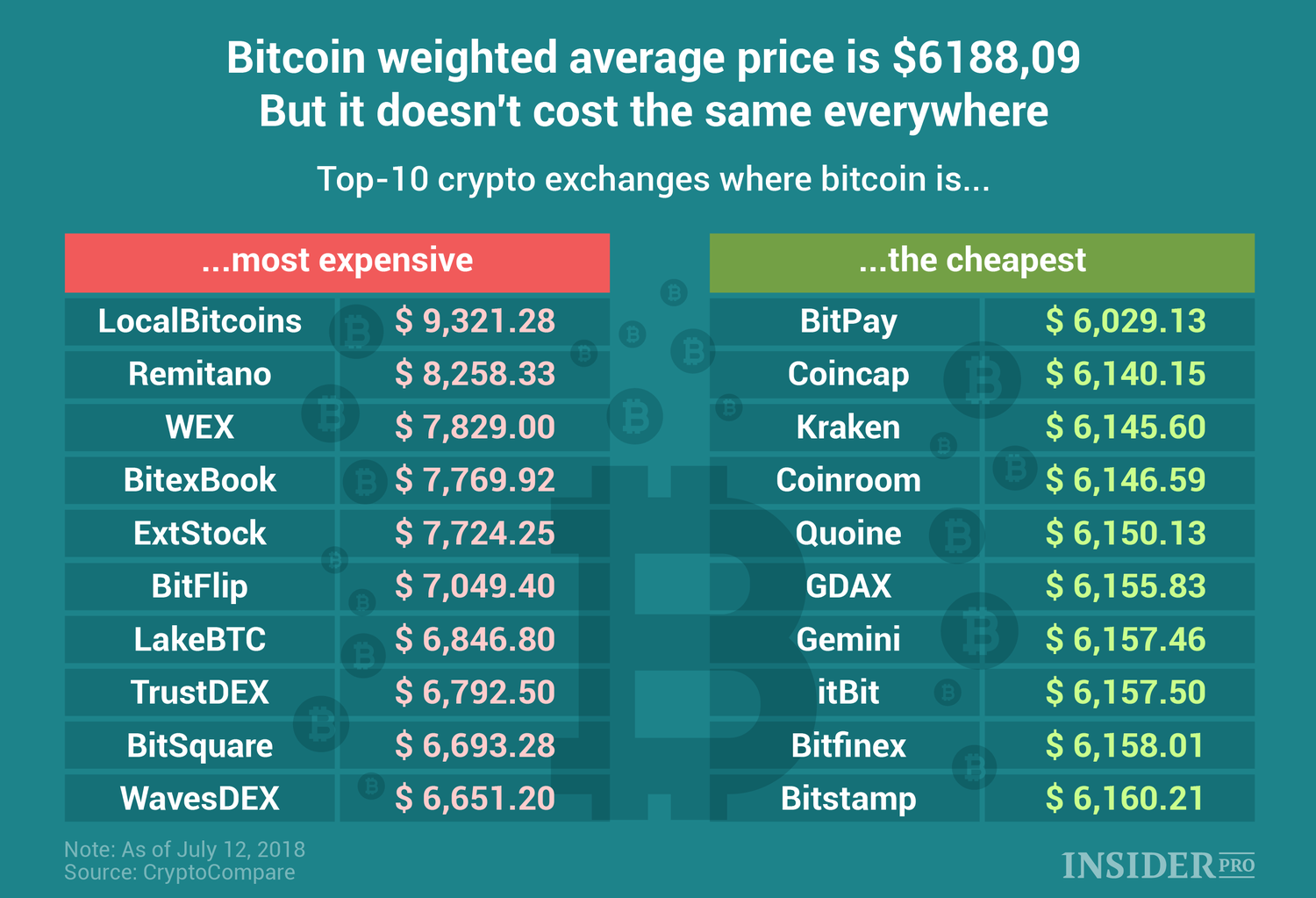

Crypto prices on exchanges vary due to factors such as trading volume, regional differences, and fee structures. There is no centralized pricing system for cryptocurrencies, so prices are based on supply and demand factors. The variation in prices opens up opportunities for arbitrage across different exchanges.

| Factors Contributing to Price Variations |

|---|

| Trading Volume on Exchanges |

| Regional Differences |

| Different Trading Pairs |

| Lack of a Standardized Pricing Protocol |

The reasons behind price variations in cryptocurrency on different exchanges are complex. One of the factors could be the trading volume on exchanges. A higher trading volume on exchanges can sometimes lead to a higher price. Another possible factor is regional differences, which can affect the price of Bitcoin. Different trading pairs on exchanges can also contribute to variation in prices. Additionally, there is a lack of a standardized pricing protocol for cryptocurrency. This means that there is no regulated or centralized pricing system for cryptocurrency and the factors that might affect the pricing will always vary from time to time.

Examples Of Price Variations On Popular Crypto Exchanges

Possible HTML response:

Prices of cryptocurrencies can vary significantly between different exchanges, and understanding the reasons behind these variations is crucial for crypto traders and investors. Some examples of price differences on popular exchanges include:

| Exchange | Cryptocurrencies | Factors |

|---|---|---|

| Coinbase | Bitcoin, Ethereum, Litecoin, etc. | Includes a spread in the price when buying or selling, and fees based on maker-taker model. |

| Binance | Wide range of altcoins and stablecoins. | Known for high trading volumes, which can impact prices. |

| Crypto.com | Bitcoin, Ethereum, Litecoin, etc. | Offers lower taker fees than Coinbase. |

| Kraken | Bitcoin, Ethereum, Ripple, etc. | Allows margin trading and provides market analysis tools. |

| KuCoin | Wide range of altcoins and tokens. | Offers various trading features, such as stop limit orders and futures contracts. |

| Bybit | Bitcoin, Ethereum, Ripple, etc. | Specializes in derivatives trading and offers leverage up to 100x. |

| OKX | Bitcoin, Ethereum, Litecoin, etc. | Provides advanced trading features, such as spot trading, futures trading, and perpetual swaps. |

These price differences can be caused by various factors, such as trading volumes, fees, regional demand, liquidity, and market inefficiencies. For instance, Binance’s high trading volumes can create demand and raise prices, while Coinbase’s spread and fees can add costs to transactions. Additionally, regional differences in demand and supply can affect prices in different countries or regions.

Therefore, it’s important to compare prices and fees on different exchanges before buying or selling crypto, and to use arbitrage opportunities, if possible, to profit from the price differences. However, be aware of the risks and challenges of arbitrage, such as low liquidity, high transaction costs, and market volatility, which can lead to losses or missed opportunities.

Strategies For Taking Advantage Of Price Differences

Possible HTML response:

Arbitrage trading, automated trading bots and manual trading are three ways to profit from the price differences between crypto exchanges:

| Technique | Description | Advantages | Disadvantages |

|---|---|---|---|

| Arbitrage trading | Buying and selling the same asset on two or more exchanges to exploit temporary pricing inefficiencies | Low risk, high speed, easy to learn | Requires capital, may need to pay fees and taxes, may face network or software issues |

| Automated trading bots | Using pre-programmed software to execute trades based on price signals and market trends | 24/7 coverage, precise execution, scalability | Costly to develop, may encounter bugs or glitches, may become obsolete |

| manual trading | Monitoring the market and making trading decisions based on fundamental and technical analysis | Flexible, personal, educational | Subjective, time-consuming, emotional bias |

While there is no regulated or centralized pricing system in the crypto market, price differences can occur due to various factors such as trading volume, regional demand, fees, spread and liquidity. By using the appropriate trading technique, one can potentially profit from these price differences and reduce the overall market volatility. However, it’s important to research and evaluate the risks and benefits of each technique before investing in any particular exchange or asset.

Potential Risks And Challenges

The cryptocurrency market is known for its volatility, leading to potential risks and challenges for investors. One of the main reasons why crypto prices differ on exchanges is because of market volatility. Different exchanges can have varying trading volumes that can influence the price of the cryptocurrency. Additionally, regional differences can lead to price variations based on where it’s being traded. Another factor is exchange fees and restrictions, which can vary and impact the price of the cryptocurrency. Lastly, security concerns can cause differences in prices, such as if an exchange has ever been hacked in the past. Overall, the lack of regulated or centralized pricing system in the cryptocurrency market leaves room for price differences across exchanges.

Regulations And Future Implications

There are a number of reasons why crypto prices differ between exchanges. One of the possible explanations for the price discrepancy is differing trading volumes. Binance, for example, is known to have higher trading volumes, which can sometimes lead to higher prices. Another reason could be regional differences, as the price of Bitcoin can vary depending on the region in which it is being traded.

When it comes to the regulatory landscape, each country has its own set of rules and regulations, which can impact the crypto market. There is no regulated or centralized pricing system, and the price on different exchanges is based on the economic and trading factors of supply and demand. Additionally, there may be future developments in regulations that could impact the market further.

The impact of regulation on the crypto market is an area of ongoing interest, as the lack of standardization creates a market where prices differ widely. While there is speculation about the potential impact of regulation, it remains unclear how this will impact the future of crypto prices. The variation in prices, however, has created opportunities for arbitrage on the market, providing traders with opportunities to profit from pricing differences across exchanges.

Frequently Asked Questions On Why Are Crypto Prices Different On Exchanges

Why Does Binance And Coinbase Have Different Prices?

Binance and Coinbase have different prices due to several reasons, including different trading volume and regional differences. Moreover, Coinbase includes a spread in the price when buying or selling cryptocurrencies, while Crypto. com and Coinbase have different fees. Nevertheless, there is no regulated pricing system, and the price of Bitcoin varies based on supply and demand factors.

Why Does Crypto Com And Coinbase Have Different Prices?

Crypto. com and Coinbase have different prices because they use different fee structures. Coinbase includes a spread in the price while Crypto. com uses a maker-taker fee structure with varying fees based on the transaction size. Additionally, regional differences and trading volume can also lead to price discrepancies.

Why Is Bitcoin Price Different On Coinbase?

The price of Bitcoin on Coinbase is different due to the inclusion of a spread in the price for buying or selling cryptocurrencies. This allows Coinbase to lock in a temporary price for trade execution while the customer reviews the details prior to submitting the transaction.

Factors such as trading volume and regional differences can also lead to differences in Bitcoin prices on different exchanges.

What Is The Price Difference On Crypto Exchanges?

Crypto prices can vary among exchanges due to factors including trading volume, regional differences, and fees. There is no regulated or centralized pricing system for cryptocurrencies. Price discrepancies across exchanges exist due to different fees that crypto exchanges charge, varying levels of trade volume and liquidity, and the factors of supply and demand.

Conclusion

To sum up, the difference in crypto prices across exchanges can be attributed to several factors such as different trading volumes, regional differences, fee structures, and the absence of a regulated or centralized pricing system. However, despite the price discrepancies, the growing popularity of cryptocurrencies has opened up new opportunities for traders to profit from arbitrage opportunities across exchanges.

It is also important to stay updated on the latest trends and market movements to make informed decisions while trading in the highly volatile crypto market.