Cryptocurrency is a digital currency that uses encryption algorithms and operates as an alternative form of payment, functioning as both a currency and a virtual accounting system. Transactions are verified and recorded on a blockchain, an unchangeable ledger that tracks and records trades and assets.

Cryptocurrencies can be used for purchases or as an investment, without the need for a bank or financial institution to verify transactions. Yield farming is a process in which one can lend their cryptocurrency to a platform in exchange for interest, allowing them to earn a profit on their investments.

The process is dependent on the platform and type of cryptocurrency being lent. However, it is important to note that the value of cryptocurrencies is determined by market demand rather than any intrinsic value.

Introduction To Cryptocurrency

Cryptocurrency is a digital currency that uses encryption techniques to secure transactions and control the creation of new units. It operates independently of a central bank and can be used for transactions or as an investment.

Bitcoin, created in 2009, was the first decentralized cryptocurrency, and since then, thousands of new cryptocurrencies have been created. Cryptocurrencies can be mined by using computers to solve complex mathematical equations.

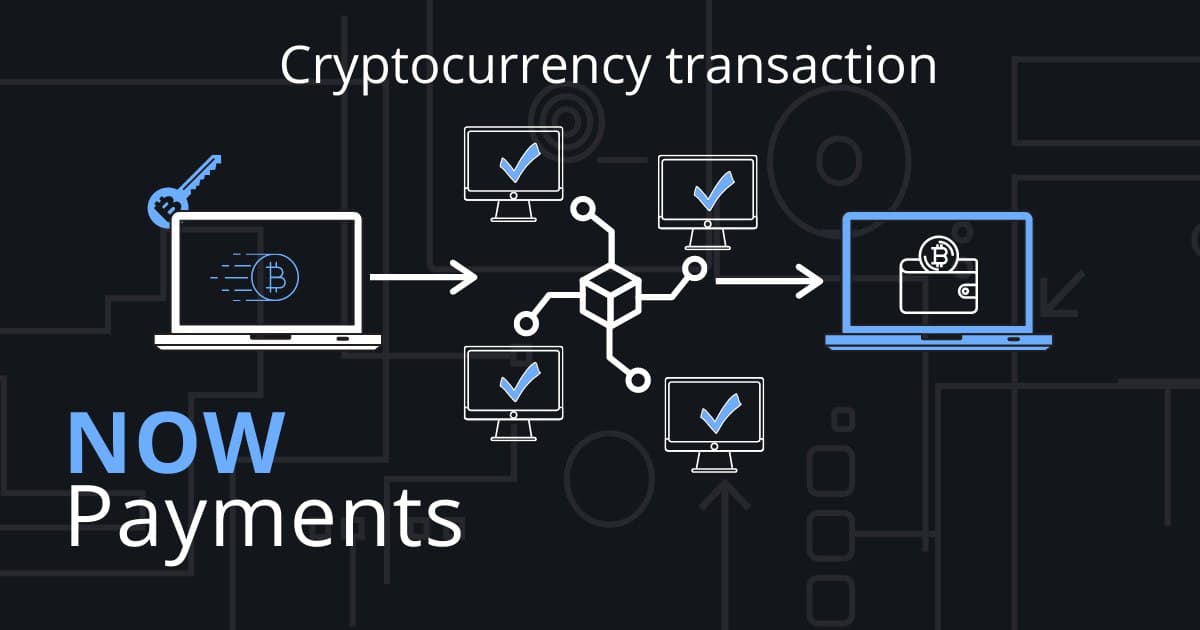

Transactions with cryptocurrency are stored on a decentralized blockchain, a public ledger that records and verifies all transactions. The decentralized nature of the blockchain makes it nearly impossible to hack or cheat the system.

While cryptocurrency has faced criticism and controversy, its popularity and adoption continue to grow. With the potential for high returns and the ease of global transactions, more and more people are turning to cryptocurrency as a viable investment option.

How Cryptocurrency Works

Cryptocurrency works through a decentralized system, where transactions are verified and recorded on a blockchain. This technology ensures that the ledger is tamper-proof and transactions are transparent. In addition to this, mining is the process of verifying transactions and adding them to the blockchain. This is done by solving complex mathematical equations, which are rewarded with newly created coins.

The blockchain technology plays a crucial role in securing the network and ensuring that transactions are processed in a timely manner. It eliminates the need for intermediaries, such as banks, and allows individuals to conduct transactions directly with each other.

Overall, the combination of decentralization and blockchain technology make cryptocurrency a unique and innovative way of conducting transactions and storing value.

Different Types Of Cryptocurrencies

Cryptocurrencies are digital tokens that have become incredibly popular in recent years. There are several types of cryptocurrencies available in the market today including Bitcoin, Ethereum, Litecoin and Ripple.

Bitcoin is the most well-known cryptocurrency and is often used as a synonym for cryptocurrencies in general. Ethereum is another popular cryptocurrency which enables developers to build and deploy decentralized applications on its blockchain. Litecoin is known for its faster transaction confirmation times and lower fees, while Ripple aims to provide secure, instantly and low-cost international money transfers.

Cryptocurrencies work through a decentralized system using blockchain technology, which allows for secure and transparent transactions without the need for a central authority like a bank. Transactions are verified and recorded on a public ledger. Investing in cryptocurrency can be done through exchanges, trading platforms, or by lending your holdings to platforms to earn interest.

Pros And Cons Of Cryptocurrency

Cryptocurrency is a digital currency that operates without a central authority and uses encryption techniques to secure transactions. The advantages of cryptocurrency include decentralization, immutability, and transparency, while the cons include volatility, lack of regulation, and exposure to scams and fraudulence.

| Benefits: | 1. Cryptocurrency offers a high level of security as transactions are encrypted and anonymous. 2. Transactions made through cryptocurrency are faster and cheaper than traditional methods. 3. Cryptocurrency is decentralized, meaning no single authority controls it and the transactions can be made anywhere in the world. |

| Risks: | 1. Cryptocurrency values are highly volatile and can fluctuate rapidly. 2. As there is no central authority, there is a lack of regulation and protection for investors. 3. Cryptocurrency exchanges are vulnerable to hacking and cyber attacks. |

| Security Concerns: | 1. Cryptocurrency exchanges are an attractive target for hackers. 2. Transactions are irreversible, which can be a problem if funds are sent to the wrong address. 3. Cryptocurrency wallets can be lost or stolen, resulting in a loss of funds. |

| Regulatory Challenges: | 1. Cryptocurrency is still not widely accepted as a form of payment, making it difficult to use in day-to-day transactions. 2. Governments around the world are grappling with how to regulate cryptocurrency, which can lead to uncertainty and instability in the market. 3. Taxation and legal issues surrounding cryptocurrency can be complex and unclear. |

Cryptocurrency has become a popular subject in recent years as it promises to revolutionize the way we transact and store value. Although it offers numerous benefits, such as better security, faster transactions, and decentralization, there are also potential risks associated with investing in it. Cryptocurrency values are highly volatile, exchanges are vulnerable to hacking, and wallets can be lost or stolen. Also, there are ongoing regulatory challenges and uncertainty surrounding its taxation and legal issues. Despite these challenges, cryptocurrency remains an exciting development in the world of finance and technology.

Investing In Cryptocurrency

Cryptocurrency is a digital currency that can be used for purchases or as an investment without requiring a bank or financial institution to verify transactions. The transactions are verified and recorded on a blockchain, an unchangeable ledger that tracks and records assets and trades. Investing in cryptocurrency involves several factors that should be considered, such as the technology behind the cryptocurrency, its popularity and adoption rate, and government regulations.

There are multiple popular trading platforms available for trading cryptocurrency, such as Coinbase, Binance, and Kraken. To be successful in cryptocurrency trading, it is essential to have a strategy that suits your investment goals and risk tolerance. Strategies such as dollar-cost averaging, hodling, and using technical analysis can help you succeed in the cryptocurrency market.

Using Cryptocurrency For Transactions

Cryptocurrency is a digital form of money that functions through a decentralized ledger technology known as a blockchain. Transactions are verified and recorded on the blockchain, which eliminates the need for banks or financial institutions to facilitate transactions. Users can earn interest on their cryptocurrency investments through a yield farming process where they lend their cryptocurrency to a platform for interest.

Cryptocurrency transactions offer several advantages over traditional payment methods. One of the most significant perks is the high level of security that cryptocurrencies provide, making transactions virtually tamper-proof. Additionally, cryptocurrency transactions are almost instantaneous, with no need for intermediaries like banks, and often lower transaction fees. There are also now many merchants and retailers that accept cryptocurrency payments, including some major companies like Microsoft, AT&T, and Overstock. Looking to the future, it’s clear that cryptocurrency transactions will continue to grow in popularity as more people become familiar with the technology and the benefits it offers.

Legal And Tax Implications Of Cryptocurrency

Understanding the legal and tax implications of cryptocurrency is crucial for anyone interested in investing in this digital currency. Cryptocurrency, such as Bitcoin, is decentralized and not backed by any government, meaning it is subject to unique taxation policies and regulations that differ from traditional currency.

It is important to educate oneself on these implications before investing.

Cryptocurrency can have legal and tax implications that are important to understand before investing or transacting. Currently, laws and regulations related to cryptocurrency vary by country and can change rapidly. In the United States, the IRS considers cryptocurrency as property for tax purposes, meaning that gains or losses from investments and transactions are subject to capital gains tax. Additionally, if cryptocurrency is used to pay for goods or services, it may be subject to sales tax. When it comes to regulation, the SEC has classified some cryptocurrencies as securities, subjecting them to additional rules and oversight. As always, it’s important to do your research and consult with a professional before making any decisions related to cryptocurrency.

Frequently Asked Questions For What Is Cryptocurrency And How It Works

How Does Crypto Make You Money?

Cryptocurrency can generate money through a process called “yield farming. ” This involves lending your cryptocurrency to a platform in exchange for interest. The amount of interest earned varies based on the platform and type of cryptocurrency lent.

How Do You Explain Cryptocurrency To A Beginner?

Cryptocurrency is digital money that doesn’t need a bank to verify transactions. It can be used for purchases or as an investment. Transactions are recorded on a blockchain, an unchangeable ledger that tracks and records assets and trades. It is traded on digital currency exchanges and is secured through encryption algorithms.

Is Crypto Real Money?

Yes, cryptocurrency is real money. It can be used to buy goods and services or traded for profit without requiring a bank or financial institution to verify transactions. It is a type of digital currency created using encryption algorithms that function both as a currency andas a virtual accounting system.

What Is Cryptocurrency In Simple Words?

Cryptocurrencies are digital tokens used for online transactions without involving banks or financial institutions. They function as a virtual accounting system, utilizing encryption algorithms for security. They have no intrinsic value and are worth what people are willing to pay for them in the market.

Conclusion

To sum it up, cryptocurrency is digital money that can be used for purchases or as an investment. It operates independently of banks and institutions and is secured using cryptography. Transactions are recorded on a blockchain ledger that cannot be altered.

Cryptocurrency can be a great investment option, but one must be cautious of scams and prioritize security measures when making transactions. As technology continues to advance, the world of cryptocurrency is constantly evolving and offering new possibilities for financial transactions.