It is important to determine the appropriate percentage of cryptocurrency in your portfolio. Factors such as risk tolerance, investment goals, and market conditions should be considered.

A well-rounded and diversified portfolio may have a range of 4% to 6% allocated to cryptocurrency. However, the specific percentage may vary for each individual based on their unique circumstances.

Analyzing Crypto Portfolio Allocation

Analyzing crypto portfolio allocation involves determining the ideal amount of cryptocurrency to hold within a portfolio. Factors to consider include risk tolerance, investment goals, and market conditions. It is essential to evaluate the potential impact on overall portfolio performance and diversification.

| When determining crypto allocation, evaluate risk tolerance and investment goals. |

| Diversify crypto holdings across various assets to spread risk effectively. |

| Consider market conditions and research potential cryptocurrencies for investment. |

Best Cryptocurrencies For Portfolio

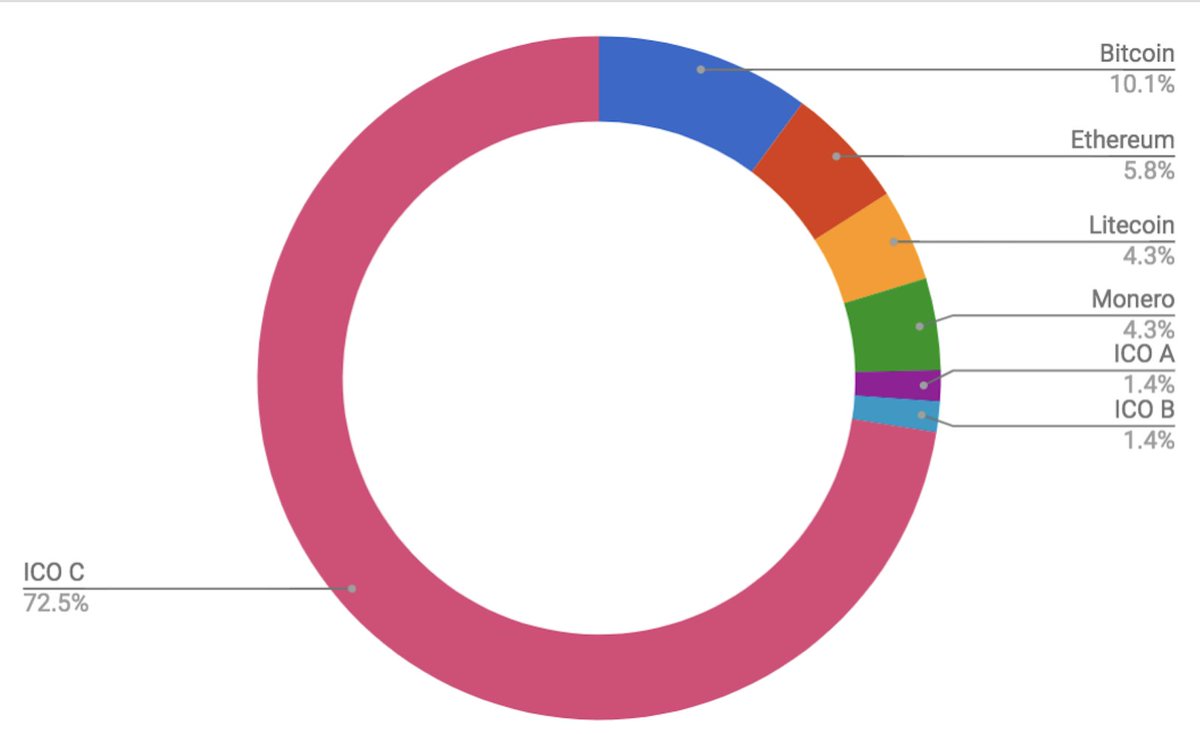

When it comes to choosing the best cryptocurrencies for your portfolio, there are several factors to consider. Firstly, it is important to look at the market performance and potential growth of the cryptocurrencies you are considering. Some of the top cryptocurrencies for investment include Bitcoin, Ethereum, Cardano, Dogecoin, Avalanche, Litecoin, TRON, Bitcoin Cash, Binance Coin, and Bitcoin. Secondly, you should also consider the diversification of your portfolio. It is generally recommended to have a diverse portfolio that includes a mix of different cryptocurrencies.

This can help mitigate the risk associated with any one cryptocurrency. Additionally, it is important to keep in mind your risk tolerance and investment goals. Some investors may choose to allocate a higher percentage of their portfolio to cryptocurrencies, while others may prefer a more conservative approach. Ultimately, the decision on how much crypto should be in your portfolio will depend on your individual circumstances and investment strategy.

For tracking and managing your cryptocurrency portfolio, there are several tools and platforms available. Some of the best crypto portfolio trackers include Gecko Labs, CryptoCom, CryptoPanic, and Crypto Pro. These platforms provide real-time data and insights to help you monitor the performance of your investments. Additionally, there are also crypto tracking sites like CoinMarketCap, Binance, CoinStats, CoinDesk, Gemini, and KuCoin that offer a wide range of information and resources for cryptocurrency investors.

Managing Crypto Investments

Managing your crypto investments is crucial to ensure a well-balanced portfolio. But how much crypto should you have in your portfolio? While there isn’t a one-size-fits-all answer, it’s important to consider diversification and risk tolerance.

Avoid putting all your eggs in one basket. Consider allocating a portion of your portfolio to cryptocurrencies that have shown long-term stability, such as Bitcoin, Ethereum, and Cardano. Diversify further by including some altcoins like Dogecoin, Avalanche, and Litecoin.

To track your crypto investments effectively, there are various tools available. Gecko Labs, Crypto.com, and CryptoPanic are popular portfolio trackers. CoinMarketCap, Binance, and Gemini are useful for tracking specific cryptocurrencies.

Remember, the ideal allocation of crypto in your portfolio depends on your individual financial goals and risk appetite. It’s always advisable to do thorough research and consult with a financial advisor before making any investment decisions.

Portfolio Allocation Strategies

Determine the ideal crypto portion in your investment portfolio with strategic allocation methods. Calculate risk factors and goals for optimal diversification and potential growth. Embrace a well-balanced approach to crypto assets to maximize returns and minimize potential losses.

| Portfolio Allocation Strategies |

| Strategic Allocation Percentages |

| Diversifying Crypto Holdings can be crucial for minimizing risk. |

| Consider allocating Bitcoin, Ethereum, Cardano, and other top cryptocurrencies. |

| Experts suggest 4-6% of a portfolio for crypto investments. |

Guidelines For Beginners

Calculating Crypto Portfolio Size can be a daunting task for beginners. It’s important to consider your risk tolerance and financial goals when determining how much of your portfolio should be in crypto. Allocating a small percentage, such as 5-10%, for beginners can help manage risk while still providing exposure to the potential growth of the crypto market. Diversification across different cryptocurrencies and asset classes is also crucial to mitigate volatility. It’s advisable to seek professional advice and thoroughly research before making any investments.

Frequently Asked Questions On How Much Crypto In Portfolio

How Much Of Your Portfolio Should Be Crypto?

A well-balanced portfolio should include a small percentage of crypto assets.

What Is A Good Crypto Portfolio Allocation?

A good crypto portfolio allocation depends on individual risk tolerance. It’s recommended to diversify and allocate a portion of your portfolio to crypto, typically 5-10%, to balance potential gains and volatility. Regularly review and adjust allocations based on market conditions.

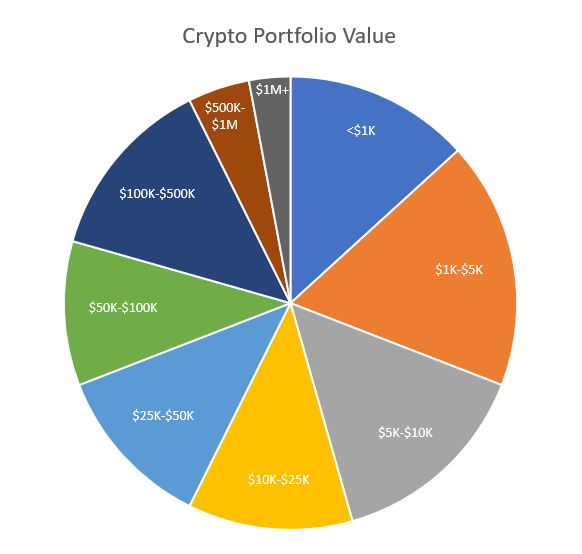

How Much Does The Average Crypto Holder Have?

On average, a crypto holder has a portfolio value of approximately $5,000 to $10,000.

Is Even A Little Bitcoin Too Much For Your Portfolio?

A little Bitcoin in your portfolio may be beneficial for diversification and potential growth.

Conclusion

Diversify your portfolio wisely with a balanced mix of cryptocurrencies for long-term growth. Research and adjust based on market trends and your risk tolerance. Take advantage of diverse assets to maximize potential returns without overexposure. Stay informed and adapt strategically to navigate the crypto market effectively.