Cryptocurrency is a digital currency that does not require a financial institution or bank to verify transactions. It can be utilized for payments or investment, and transactions are verified and recorded via a blockchain.

The blockchain is an unchangeable ledger that tracks and records trades and assets. Cryptocurrencies run on a distributed public ledger called blockchain, and units of cryptocurrency are generated through a process called mining. Cryptocurrencies are worth what individuals are willing to pay for them in the market, as they have no intrinsic or legislated value.

We will discuss in detail how cryptocurrency works and the benefits and risks of investing in it. We will also go over some popular cryptocurrencies in circulation and how trading works to help beginners better understand this innovative technology.

Introduction To Cryptocurrency

Cryptocurrency is a digital form of currency that operates through a decentralized network without a central authority like banks or financial institutions. Transactions are verified and recorded on a blockchain, an unchangeable ledger that tracks and records assets and trades.

Cryptocurrency can be used for purchases or as an investment and involves mining, a process that generates coins through solving complicated mathematical problems using computer power.

| Definition of Cryptocurrency |

|---|

| Cryptocurrency is digital money that operates independently of any central bank or financial institution. It uses cryptography techniques to secure and verify transactions and is based on a decentralized system where all transactions are recorded on a public ledger called the blockchain. |

| History of Cryptocurrency |

| The first cryptocurrency, Bitcoin, was created in 2009 by an unknown individual or group known as Satoshi Nakamoto. Since then, the popularity of cryptocurrencies has grown with the introduction of other popular digital currencies such as Ethereum, Ripple, and Litecoin. Today, cryptocurrencies are used for a variety of purposes, from making purchases to investments and even earning interest. |

| Popular Cryptocurrencies |

| Some of the popular cryptocurrencies include Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash. Each cryptocurrency offers unique features and benefits, and investors should do their own research before investing their money. It’s important to note that the value of cryptocurrencies can be highly volatile and can fluctuate quickly, so it’s important to invest with caution and only with money that you can afford to lose. |

How Cryptocurrency Works

Cryptocurrency is a form of digital currency and a type of investment. Transactions with cryptocurrency do not require a bank or financial institution to certify transactions and can be used for purchases. Cryptocurrencies are recorded on a blockchain, which is an immutable ledger that records transactions. These transactions are verified and recorded by individuals known as miners who use their computing power to solve complex mathematical problems.

Once the miners have solved these problems, they receive a reward in the form of cryptocurrency. The value of cryptocurrencies is based on the market demand and is worth what people are willing to pay for them. There is also a process called yield farming, where you lend your cryptocurrency to a platform in exchange for interest or you can trade the cryptocurrency on exchanges.

| Pros | Cons |

|---|---|

| Decentralized | Unregulated market |

| Immutable transactions | High Volatility |

| Fast and cheap transaction fees | No physical asset tied to the investment |

Uses And Benefits Of Cryptocurrency

Cryptocurrency is a type of digital money that operates independently of banks or financial institutions. It works through a decentralized system where transactions are verified and recorded on a blockchain ledger, which keeps track of assets and trades. This creates a secure and trustworthy system for making purchases or as an investment opportunity with potential for earning interest.

Cryptocurrency, also known as digital currency, is becoming increasingly popular around the world due to its many benefits. One of the main advantages of using cryptocurrency for international transactions is the low transaction fees. Since cryptocurrency doesn’t involve banks or financial institutions, transaction fees are significantly lower than traditional methods of transferring money across borders. Additionally, cryptocurrency provides a high level of anonymity and privacy, which is particularly useful for people who prioritize their privacy.

This feature also makes transactions more secure, as they are recorded and verified on a blockchain, which is an unchangeable and secure ledger. Finally, cryptocurrency offers investment opportunities for those interested in this growing market. It can help you earn interest on your investments through a “yield farming process,” where you lend your cryptocurrency to a platform in exchange for interest. Overall, cryptocurrency offers many benefits and is an innovative option for personal and business transactions.

Risks And Concerns

Cryptocurrency is a digital form of money that operates independently from a financial institution, and transactions are verified and recorded on a decentralized ledger called blockchain. However, there are risks and concerns associated with cryptocurrency, such as volatility, security threats, and lack of regulation.

| Risks and Concerns |

| Lack of Regulation |

| Cryptocurrency transactions are not regulated by central authorities, which can lead to fraudulent activities and lack of protection for users. |

| Market Volatility |

| Cryptocurrencies are highly volatile, and their value can fluctuate rapidly, making them risky investments. |

| Security Threats |

| Cryptocurrency wallets can be hacked, and digital coins can be stolen. Investors have to take extra steps to safeguard their investments. |

| Limited Acceptance |

| Not many merchants accept cryptocurrencies yet, which makes it challenging for users to use them for everyday purchases. |

Getting Started With Cryptocurrency

Cryptocurrency is a type of digital money that allows for peer-to-peer transactions without the need for a bank or financial institution to verify them. When you buy cryptocurrency, you need to store it in a wallet, which can be either hardware or software-based. You can buy cryptocurrency on a cryptocurrency exchange or a peer-to-peer network. Storing your cryptocurrency securely is of utmost importance, and you need to ensure that your wallet is protected from hacks and other security threats.

When you decide to sell your cryptocurrency, you can do so on an exchange or a peer-to-peer network. The process of selling is similar to buying, and you need to ensure that you cash out your cryptocurrency at the best possible rate. Overall, cryptocurrency can be used for purchases or as an investment, and transactions are verified and recorded on a blockchain, an unchangeable ledger that tracks and records assets and trades.

Investing In Cryptocurrency

Cryptocurrency is a type of digital money that operates independently of banks or financial institutions. Transactions are verified and recorded on a blockchain ledger that tracks assets and trades. Mining is the process used to create coins, and yield farming can help you earn interest on your investments.

| Understanding Cryptocurrency Market |

| Cryptocurrency is a decentralized market that is influenced by various external factors such as geopolitical events, regulations, innovations and overall market sentiment. It is important to stay informed and up-to-date on the market trends and fluctuations to make informed investment decisions. |

| Factors Affecting Cryptocurrency Prices |

| The prices of cryptocurrencies are affected by various factors such as supply and demand, adoption rate, technological advancements, government regulations, competition and overall market sentiment. It is important to understand these factors and their impact on the market to make informed investment decisions. |

| Types of Investment Strategies |

| There are various investment strategies in the cryptocurrency market such as HODLing, swing trading, day trading and scalping. Each strategy has its own advantages and disadvantages, and it is important to choose a strategy that aligns with your investment goals, risk tolerance and available time. |

| Risks and Rewards of Investing |

| The cryptocurrency market is highly volatile with higher risks and rewards compared to traditional markets. It is important to thoroughly research and understand the market before investing and to have a proper risk management strategy in place. However, the potential rewards in the cryptocurrency market could be substantial, and investors can benefit from diversifying their portfolio with cryptocurrencies. |

Future Of Cryptocurrency

Cryptocurrency is a digital form of currency that exists electronically, without the involvement of any financial institution. Transactions are recorded on an unchangeable ledger called blockchain, ensuring security and transparency. It can be used as a mode of payment or investment, with users earning interest through a process known as “yield farming.

| Major Trends in Cryptocurrency Industry | Impact of Cryptocurrency on Traditional Finance | Government Regulations | Adoption and Acceptance |

|---|---|---|---|

| – Increased interest and investment in blockchain technology – Growth of decentralized finance (DeFi) applications – Emergence of new cryptocurrencies | – Disrupting the traditional banking sector – Providing financial access to unbanked populations – Potential threat to central banks’ control over monetary policy | – Varying degrees of acceptance and regulation across different countries and jurisdictions – Concerns about criminal activity facilitated by cryptocurrencies | – Increased adoption by businesses and consumers – Acceptance as a form of payment in various industries – Potential as a hedge against inflation |

Cryptocurrency is digital money that operates independently from traditional banking institutions. Transactions are verified and recorded on a blockchain, which is an unchangeable ledger that tracks and records assets and trades. The future of cryptocurrencies will be shaped by major trends such as the increased interest and investment in blockchain technology, growth of decentralized finance applications, and the emergence of new cryptocurrencies.

The impact of cryptocurrency on traditional finance includes disrupting the traditional banking sector, providing financial access to unbanked populations and potentially threatening central banks’ control over monetary policy. Government regulations vary across different countries and jurisdictions with concerns about criminal activity facilitated by cryptocurrencies. Adoption and acceptance of cryptocurrencies is growing among businesses and consumers with potential as a hedge against inflation.

Frequently Asked Questions On How Does Cryptocurrency Work In Simple Terms

How Do You Explain Cryptocurrency To A Beginner?

Cryptocurrency is digital money that can be used to buy things or invest. No bank is needed to verify transactions because they are recorded on a blockchain, which is an unchangeable ledger used to track assets and trades. It’s mined through a process that involves using computer power to solve complex math problems that generate coins.

How Does Crypto Make You Money?

You can earn money through cryptocurrency by lending your coins to a platform in exchange for interest, in a process called “yield farming. ” The amount of interest you gain depends on the platform and the type of cryptocurrency you’re lending.

Additionally, cryptocurrency can be used as a payment method or as an investment.

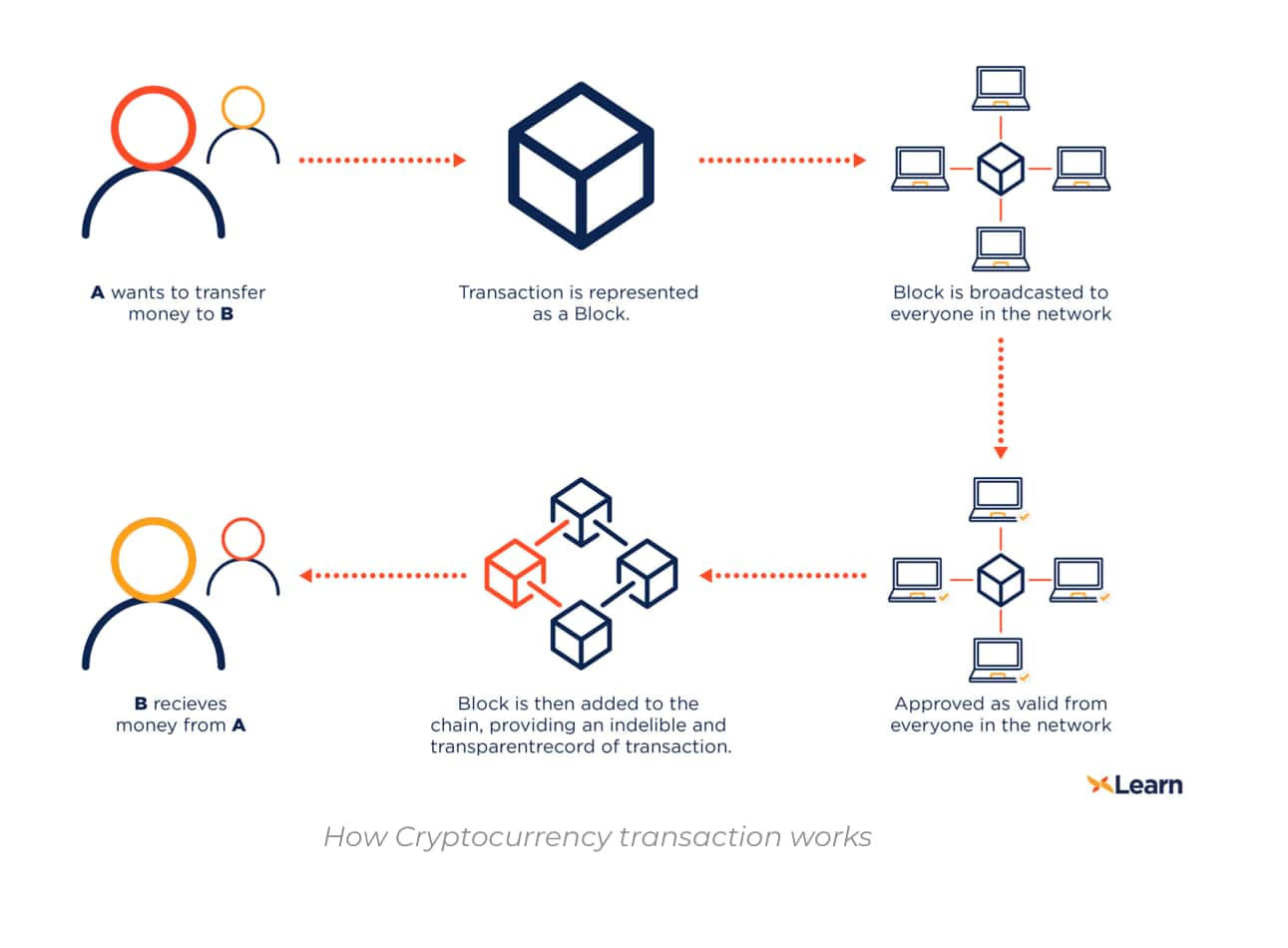

How Does Cryptocurrency Work Step By Step?

Cryptocurrency is digital money that operates on a distributed public ledger called blockchain. Transactions are verified and recorded by currency holders. Cryptocurrency is created through a process called mining, where computer power is used to solve mathematical problems. The blockchain is an unchangeable ledger that tracks and records trades and assets.

Cryptocurrency can be used for purchases or as an investment.

How Does Cryptocurrency Become Real Money?

Cryptocurrency becomes real money when it is exchanged for fiat currency (government-issued currency such as dollars or euros) through an exchange platform or peer-to-peer transaction. The value of cryptocurrency can fluctuate based on supply and demand and market conditions.

Conclusion

Cryptocurrency may seem complex, but after understanding its fundamentals, it is not so hard to grasp. In its simplest form, cryptocurrency is a decentralized digital form of currency that can be used for purchases or investments globally without the need for a financial institution.

All transactions are verified and recorded on a blockchain ledger, ensuring transparency and security. As the world continues to evolve towards a more digital era, understanding cryptocurrency and its impact on the economy can be crucial in financial success.