Cryptocurrency exchanges match buyers with sellers, enabling trading between users seeking to buy and sell digital assets. These platforms facilitate transactions and provide a marketplace for cryptocurrencies.

In the world of digital currency, cryptocurrency exchanges play a vital role in enabling users to buy, sell, and trade various cryptocurrencies. Acting as intermediaries, these exchanges provide a platform for individuals to transact with each other, matching buyers looking to purchase cryptocurrencies with sellers looking to offload their digital assets.

By creating a marketplace for trading, cryptocurrency exchanges help establish the value of different cryptocurrencies based on supply and demand dynamics. Additionally, they offer features like account creation, deposit and withdrawal options, and trading orders to streamline the buying and selling process for users. Through these facilities, cryptocurrency exchanges contribute significantly to the liquidity and accessibility of the digital asset market.

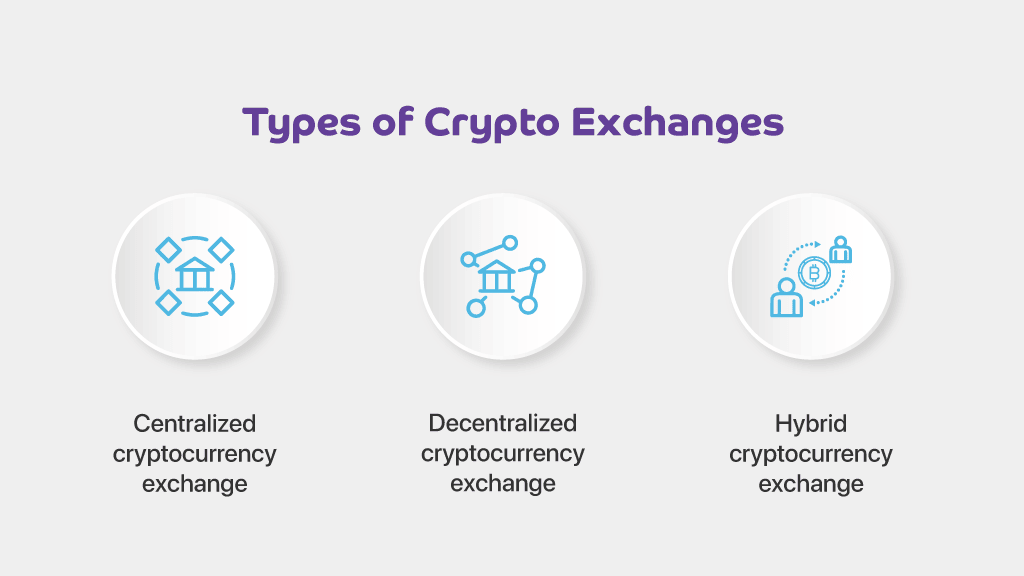

Types Of Cryptocurrency Exchanges

Cryptocurrency Exchanges are platforms where users can buy, sell, and trade cryptocurrencies. There are different types of exchanges: centralized, decentralized, and hybrid. Centralized exchanges are operated by a central authority, and they require users to deposit their funds before trading. On the other hand, decentralized exchanges operate without a central authority, allowing peer-to-peer trading and providing more control over funds.

Lastly, hybrid exchanges combine features of both centralized and decentralized exchanges, offering benefits such as liquidity and security while maintaining user control. Understanding the functions of each type is important for engaging in cryptocurrency trading.

How Do Cryptocurrency Exchanges Work

Creating an Account: To get started with a cryptocurrency exchange, you need to create an account by providing personal information and verifying your identity.

Deposit and Withdrawal: Once your account is set up, you can deposit funds into your exchange account using various methods such as bank transfer, credit/debit cards, or other cryptocurrencies. Similarly, you can withdraw your funds using the same methods.

Trading Pairs: Cryptocurrency exchanges offer a variety of trading pairs, allowing users to trade one cryptocurrency for another. Each pair represents the exchange rate of one cryptocurrency for another.

Order Types: Users can place different types of orders on a cryptocurrency exchange, such as market orders, limit orders, and stop orders. These orders determine the conditions under which a trade will be executed.

Pros And Cons Of Cryptocurrency Exchanges

A cryptocurrency exchange is an online platform that allows users to trade various cryptocurrencies. By matching buyers and sellers, these exchanges facilitate the buying and selling of digital assets. The advantages of using cryptocurrency exchanges include:

- Convenience: Users can access exchanges from anywhere and at any time, making it easy to participate in the crypto market.

- Liquidity: Exchanges pool together a large number of traders, ensuring that there is always a market for buying and selling cryptocurrencies.

- Security: Reputable exchanges employ high-level encryption and security protocols to safeguard users’ funds and personal information.

- Access to a range of cryptocurrencies: Exchanges typically offer a wide variety of cryptocurrencies, allowing users to diversify their holdings.

While cryptocurrency exchanges offer numerous advantages, they also come with some downsides:

- Risk of hacks and scams: The digital nature of cryptocurrencies leaves exchanges vulnerable to cybersecurity threats, potentially resulting in the loss of funds.

- Regulatory uncertainty: The cryptocurrency industry is still relatively new and governments around the world are still working on establishing clear regulations, which can create uncertainty for exchanges and traders alike.

- Volatility: Cryptocurrency markets are known for their high volatility, which can lead to significant price fluctuations and potential losses for investors.

Security Measures For Cryptocurrency Exchanges

Cryptocurrency exchanges employ robust security measures to protect user funds and personal information. These measures include two-factor authentication, cold storage of assets, encrypted communications, and thorough background checks for employees. By implementing these security protocols, exchanges strive to ensure a safe and secure trading environment for their users.

| Two-Factor Authentication: This is an important security measure requiring two methods to verify identity. |

| Cold Storage: Cryptocurrency funds are stored offline to prevent hacking attempts. |

| Encryption: Data is encrypted to safeguard sensitive information from unauthorized access. |

Regulation And Compliance

Cryptocurrency exchanges work by facilitating the trading of digital currencies. They match buyers and sellers, and profit from transaction fees. Regulation and compliance are crucial for exchanges to operate legally. KYC (Know Your Customer) procedures verify user identities to prevent fraud and money laundering. AML (Anti-Money Laundering) regulations require exchanges to monitor and report suspicious activities. Exchanges also store and secure users’ funds, often using cold storage to prevent hacking. These measures aim to ensure the safety and integrity of the cryptocurrency market.

Future Of Cryptocurrency Exchanges

Cryptocurrency exchanges work as platforms that facilitate the buying and selling of digital assets. They earn revenue through transaction fees and trade volumes. With the increasing institutional adoption of cryptocurrencies, exchanges are experiencing growth. Technological advancements have enhanced security measures and accelerated transaction speeds. Exchanges serve as intermediaries, connecting traders and investors in a decentralized manner.

Frequently Asked Questions For How Do Cryptocurrency Exchanges Work

How Does A Crypto Exchange Make Profit?

A crypto exchange makes profit through trading fees charged on transactions made by users.

Where Do Crypto Exchanges Get Their Coins From?

Crypto exchanges get coins from sellers who list them on the platform for buyers to purchase.

How Do Crypto Exchanges Convert Crypto To Cash?

Crypto exchanges convert crypto to cash by allowing users to trade or sell their cryptocurrency for fiat currency, such as U. S. dollars or other traditional currencies. Users create an account, deposit their cryptocurrency, set up a sell order, and once it’s filled, they can withdraw the cash to their bank account.

How Do I Exchange Cryptocurrency For Money?

To exchange cryptocurrency for money, use a cryptocurrency exchange platform to sell your coins for fiat currency. Create an account, deposit your crypto, set up a sell order, and withdraw the cash to your bank account. You can also use a broker, a peer-to-peer trade, a Bitcoin ATM, or trade one crypto for another.

Conclusion

Cryptocurrency exchanges play a crucial role in facilitating the buying and selling of digital currencies like Bitcoin. These platforms act as intermediaries, connecting buyers and sellers, and enable users to convert their cryptocurrencies into traditional fiat currencies. Additionally, exchanges can generate profits through various means such as transaction fees.

Whether centralized, decentralized, or hybrid, understanding how crypto exchanges work is essential for investors to make informed decisions. So, if you’re ready to dive into the world of cryptocurrencies, start by familiarizing yourself with the workings of these exchanges.