You can write off up to $3,000 in crypto losses on your tax return annually. Are you an investor in cryptocurrencies and faced losses?

If so, you might be wondering about tax implications related to those losses. Understanding how much of these losses you can write off can help you minimize your tax burden in the long run. Cryptocurrency investments can be volatile, and knowing the tax rules regarding losses is crucial for investors.

We will explore the guidelines around tax deductions for crypto losses and how they can affect your overall tax situation.

How Crypto Losses Impact Your Taxes

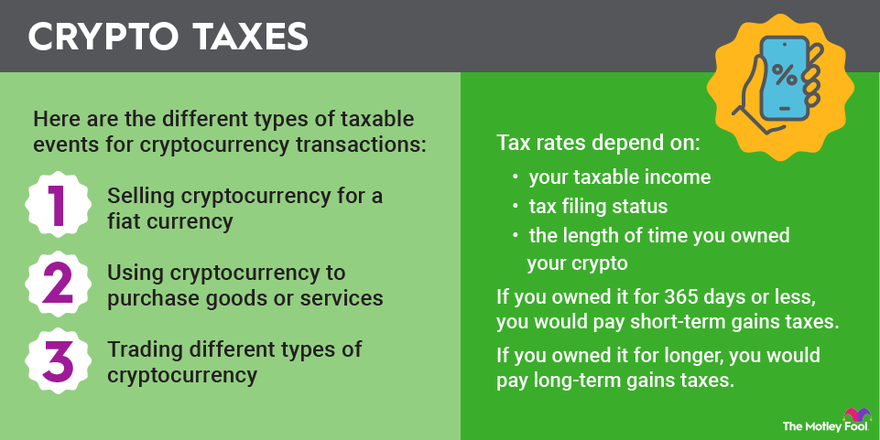

Unless they are earning interest from staking or other scenarios, cryptocurrencies are not subject to IRS taxes when you hold them in your portfolio. However, once you sell cryptocurrency for more than you paid for it, you have capital gains to report.

The IRS may classify your sale—whether as a gain or a loss—as long-term if the asset is held one year or longer. Long-term capital gains receive favorable tax rates. If you held the asset for less than a year, it is considered short-term, and you will pay ordinary income tax rates. If you sell your crypto for a loss, the IRS allows you to offset losses against other income on your tax return.

These so-called “realized losses” can be used to offset other taxable investment profits. When you hear the term “realized,” it usually means that an asset was sold. But with cryptocurrency, you “realize” gains or losses any time you dispose of crypto, including when you spend it on purchases or exchange one crypto for another.

Claiming Crypto Losses On Taxes

If you’ve experienced losses in crypto investments, you may wonder if you can claim them on your taxes. To be eligible to claim crypto losses, you need to provide evidence of ownership. However, there are limitations and exclusions to consider when reporting these losses on your tax returns.

For instance, if your digital asset investment account is frozen or tied up in bankruptcy proceedings, you may not be able to claim a taxable loss. Understanding the rules and requirements for claiming crypto losses is crucial to ensuring that you comply with tax regulations.

How much can you save by claiming crypto losses

Whether you’re offsetting capital gains or income, crypto losses can lead to large tax-savings:

Capital gains: As stated earlier, crypto losses can offset an unlimited amount of capital gains. The tax rate you pay on gains varies depending on whether they are short-term (taxed between 10-37%) or long-term (taxed between 0-20%). If you have a large amount of capital gains, you can potentially avoid a large tax liability.

Income: Depending on your tax bracket, ordinary income is taxed between 10-37%. If you write off the full $3,000 of income for the year, your tax-savings will range between $300 for those in the lowest bracket to $1,110 to those in the highest bracket.

The Wash Sale Rule and Crypto

There’s an extra benefit that cryptocurrency has over stocks and other conventional assets when selling at a loss. In 2014, the IRS said that for tax purposes, virtual currency should be treated as property rather than as a capital asset, like a stock.

This is important because capital assets are subject to wash sale rules while property is not.

Wash sale rules bar investors from harvesting tax benefits by selling capital assets for a loss and then immediately repurchasing the same or a broadly similar asset within thirty days of the sale. Since crypto isn’t considered a capital asset, it’s not subject to the rule.

This means that if you’ve got losses built up but want to hold your crypto for the long term, you could sell your coin on a down day, realize the loss on your taxes and immediately buy it again.

Tips For Managing Crypto Losses

Keeping Track of Transactions: It is crucial to keep detailed records of all cryptocurrency transactions, including purchases, sales, and exchanges. This documentation will be essential for accurately calculating and reporting your losses.

Consulting with a Tax Professional: Seeking advice from a qualified tax professional is highly recommended when dealing with crypto losses. They can provide personalized guidance based on your specific financial situation and help you navigate the complexities of cryptocurrency taxation.

Taking Advantage of Tax Deductions: Understanding the available tax deductions for crypto losses is key. By leveraging these deductions effectively, you can mitigate the impact of your losses and potentially reduce your overall tax liability.

Frequently Asked Questions Of How Much Crypto Losses Can You Write Off

What Happens If You Lose Money In Crypto?

If you lose money in crypto, you may be able to claim a capital loss on your tax return by providing evidence of ownership. However, if your digital assets are frozen or tied up in bankruptcy proceedings, you cannot claim a taxable loss.

Can I Claim Crypto Losses On My Tax Return?

Yes, you can claim crypto losses on your tax return with proper evidence of ownership.

Can I Write Off Crypto Losses Due To Bankruptcies?

If your digital asset investment is frozen or tied up in bankruptcy proceedings, you can’t write off crypto losses.

Do You Have To Report Crypto Under $600?

Yes, you should report all crypto transactions, including those below $600, on your taxes.

Conclusion

Navigating the world of cryptocurrency losses can be complex, but it’s important to understand that you may be able to write off these losses on your taxes. By providing evidence of ownership and completing the necessary steps, you can potentially reduce your tax liability.

However, it’s crucial to consult with a tax professional for personalized advice and guidance based on your specific situation. Taking the time to understand the rules and regulations surrounding crypto losses can ultimately help you save money and maximize your tax benefits.