To get started with crypto trading, you need to research and choose a reputable cryptocurrency exchange. Start by opening an account on the chosen platform and familiarizing yourself with the trading interface.

Once you’re comfortable with the basics, consider investing a small amount to begin practicing your trading skills. It’s important to stay updated with market trends and continuously educate yourself about different cryptocurrencies and trading strategies to make informed decisions. Remember to only invest what you can afford to lose and to always prioritize security when dealing with cryptocurrencies.

In this guide, we’ll explore everything you need to know about entering the world of crypto trading, from finding the right exchange to understanding market analysis and risk management.

Benefits Of Crypto Trading

Crypto trading offers high potential returns compared to traditional investments, making it an attractive option for investors seeking significant profits. Additionally, it allows for diversification of investment portfolios, reducing overall risk. With the global traction of cryptocurrencies, it has become easier for individuals to enter the market and take advantage of these benefits.

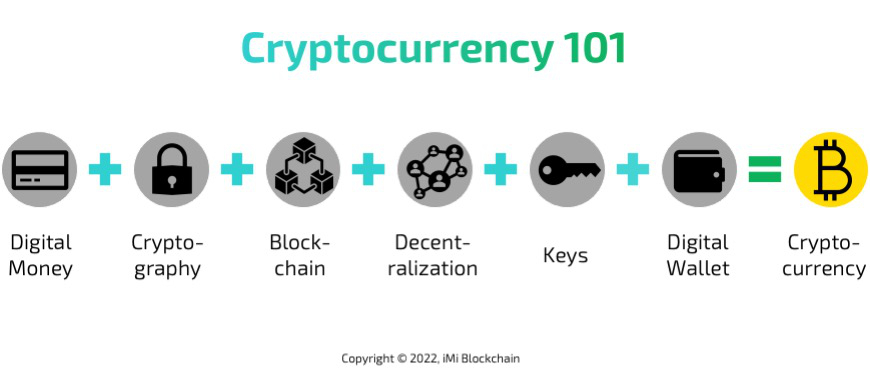

Understanding Cryptocurrency Basics

Cryptocurrency is a digital or virtual form of money that uses cryptography for secure transactions.

Bitcoin, Ethereum, and Ripple are some key cryptocurrencies to be familiar with when starting out.

Choosing The Right Exchange Platform

Begin your crypto trading journey by selecting the ideal exchange platform. Look for user-friendly interfaces, robust security features, and a wide range of supported cryptocurrencies. Research thoroughly and compare options to make an informed decision for successful trading.

| Factors to Consider: | Popular Crypto Exchange Platforms |

| Security and Regulation | Exchanges like Coinbase, Binance, and Kraken |

| Trading Fees and Commissions | Coinbase offers user-friendly interface and low fees |

| Supported Cryptocurrencies | Binance provides extensive range of cryptocurrencies |

Setting Up A Secure Wallet

Setting up a secure wallet is the first step in entering the world of crypto trading. It is important to choose the right type of crypto wallet to ensure the safety of your digital assets. There are several types of wallets available, including hardware wallets, software wallets, and online wallets. Hardware wallets provide an extra layer of security by storing your private keys offline. Software wallets, on the other hand, are installed on your computer or smartphone. Online wallets, also known as web wallets, are accessible through a web browser.

To maintain the security of your wallet, it is essential to follow best practices. First, always use a strong password and enable two-factor authentication. Regularly update your wallet software to ensure you have the latest security patches. Be cautious of phishing attempts and only download wallets from official sources. Additionally, consider keeping a backup of your wallet in a secure location. By following these best practices, you can protect your crypto assets from potential threats.

Developing A Trading Strategy

When getting started with crypto trading, it’s essential to develop a trading strategy that suits your goals and risk tolerance. This will help you make informed decisions and minimize potential losses. There are various types of trading strategies you can consider:

- Day trading: This strategy involves opening and closing trades within a single day, taking advantage of short-term price fluctuations.

- Swing trading: Here, traders aim to capture medium-term trends by holding positions for a few days to weeks.

- Long-term investing: This strategy involves buying and holding cryptocurrencies for an extended period, potentially benefiting from long-term price appreciation.

Additionally, it’s crucial to incorporate risk management techniques into your trading strategy. These may include setting stop-loss orders to limit potential losses and diversifying your portfolio to spread risk. Remember to stay updated with market news and analysis to make informed trading decisions.

Market Analysis And Research

To get started with crypto trading, it is essential to conduct market analysis and research. By assessing historical data, market trends, and understanding various cryptocurrencies, traders can make informed decisions and maximize their potential for success in the volatile crypto market.

| Technical Analysis Tools | Fundamental Analysis |

| Use indicators like moving averages for price trends. | Study market news and financial statements. |

| Chart patterns help predict future price movements. | Evaluate the project’s team and technology. |

Executing Trades And Monitoring

Placing Orders: When getting started with crypto trading, it is crucial to understand the process of placing orders. Knowing the difference between market orders and limit orders can help you make informed decisions. Market orders are executed at the current market price, while limit orders allow you to set a specific price at which you want to buy or sell. It’s important to carefully consider the potential impact of each type of order before making a trade.

Monitoring Market Movements: Tracking market movements is essential for successful crypto trading. Utilizing technical analysis tools and staying updated with market news and trends can provide valuable insights. Setting up price alerts and utilizing stop-loss orders can help you manage risks and seize opportunities. Regularly monitoring the market can help you make well-informed trading decisions.

Managing Risks And Emotions

Risk Mitigation Strategies: When getting started with crypto trading, it’s important to implement risk mitigation strategies to protect your investments. Diversifying your portfolio across different cryptocurrencies can help minimize the impact of potential losses. Utilizing stop-loss orders can also help limit risk by automatically selling a cryptocurrency if its price falls to a certain level. Additionally, conducting thorough research and staying informed about market trends can aid in making informed trading decisions.

Controlling Emotions in Trading: Emotions can heavily influence trading decisions, leading to impulsive actions and potential losses. Implementing a trading plan and sticking to it can help in controlling emotions. Setting predefined entry and exit points, along with risk and reward targets, can provide a structured approach to trading. It’s essential to remain disciplined and avoid making decisions based on fear or greed. Utilizing tools such as technical analysis can also aid in removing emotional bias from trading decisions.

Frequently Asked Questions On How To Get Started With Crypto Trading

How Can I Get Started With Crypto Trading?

To get started with crypto trading, you need to create an account on a reputable cryptocurrency exchange platform. Then, you will need to complete the verification process and deposit funds into your account. Once your account is funded, you can start trading by buying and selling cryptocurrencies.

What Are The Risks Associated With Crypto Trading?

Crypto trading carries certain risks, including market volatility, regulatory changes, and potential security breaches. It’s important to do thorough research, set realistic expectations, and only invest what you can afford to lose. Utilizing risk management tools and strategies can also help minimize potential losses.

What Is The Difference Between Cryptocurrency Trading And Investing?

Cryptocurrency trading involves actively buying and selling cryptocurrencies in order to profit from short-term price movements. On the other hand, cryptocurrency investing involves holding onto cryptocurrencies for the long term, with the expectation that their value will increase over time.

Trading requires more active involvement and monitoring of the market, while investing takes a more passive approach.

Conclusion

Ready to embark on your crypto trading journey? Armed with essential knowledge and practical tips, you can navigate the exciting world of cryptocurrency trading confidently. Remember to start with small steps, stay informed, and continuously learn to adapt to the dynamic crypto market landscape.

Good luck on your trading endeavors!